Good day to all

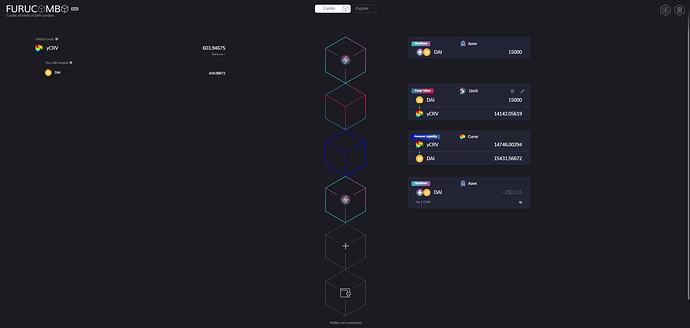

I have been looking at a platform called Furucombo. https://furucombo.app/. What is really nice about this is that it allows a user-friendly interface to ETH contracts. You can create really complicated contracts by swapping, taking flash loans, etc all with a click of a button. Below is a screenshot of an example of what you can do.

If you connect your MetaMask account to it the possibilities of what you can do and the combinations of transactions are virtually endless.

The one aspect that I thought could be really nice with this platform with the use of an Aave flash loan and the 5 odd DEFI exchanges that are available is to look for arbitrage opportunities for the different tokens but with the use of a flash loan. If there is a real good opportunity along with the flash loan (someone else’s liquidity) you could really gain a lot on the token of your pleasing. The only thing that you would need to consider is the GAS price/transaction cost as that isn’t calculated into their platform.

The difficulty that I have is to spot or track the arbitrage opportunities as there are so many exchanges and so many tokens out there.

I would love to hear if someone has come across an app, webpage, or the likes that can show the arbitrage opportunities. I know you could write software in solidity or even Python with the APIs that are available but would love a more user-friendly kind of way.

Kind Regards