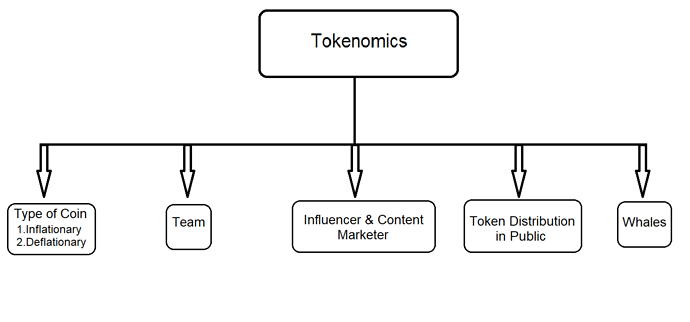

Tokenomics is a fancy word for saying economics of an asset for early coins. So the initial tokenomics is a great source of information. Often you can view the tokenomics on a project’s website or their white paper.

There are five parts I listed.

(1) Type of coin:

Inflationary:

- The coins have no limit to how many units are in circulation.

- The coins will continue to be created and have no limit in circulation. The price of a coin goes down as time goes on.

- So unless there is a reason to keep buying, the price will go down

- For example, the US dollar is inflationary, they keep printing more dollars, and every year its worth is getting less meaning it takes more and more dollars to buy the same thing.

Deflationary:

- Deflationary cryptocurrency tokens are the ones that have a reduction in supply over time or there is a regular burning mechanism of coins. The price increase assumes no other changes in the market. Because as time moves on, there are fewer tokens to buy. So the demand stays the same, the price will increase.

- For Example, Bitcoin.

- It has a limited supply i.e a certain amount of bitcoin can be mined.

(2)Team

- The people behind a project are very important. Do your research on them, check out their Social Media and Linkedin and make sure you trust them with your money.

(3)Influencer & Content Marketer:

- Find out the content creator who specializes in only one project. Look over their Twitter profile or Youtube channel. See if they have made good calls in the past. Since it is their reputation online, they will not be promoting a pump and dump even if they claim that it’s not financial advice.

- If you find niche content creators, then it is a very good sign, especially if they’re creating lots of content. If someone spends their time and energy to bring new people into a coin by creating content, it does mean a community may form or that they might lead new investors to the project, which may or may not be good, but is an important piece of information knowing as a potential investor.

(4)Token Distribution in Public

- Find out the presale data, as some tokens are sold to private investors.

- Few tokens are given out to early users and some are mined by a closed group set of miners.

- Another way of Public release of the coin is ICO. It is “Initial Coin Offering” is an unregulated means by which funds are raised for a new cryptocurrency venture

- Airdrop is also another way of rewarding tokens to their users.

- Vosk has tonnes of videos on Airdrops. He reviews and informs a potential new airdrop and how to participate in it.

(5)Whales

- Check out their wallets. One of the easiest ways to do this is to use on-chain analysis and one of the most powerful on-chain signals is whale movements.

- If the supply of a coin or token is heavily concentrated among a few wallets, there’s a big risk that one of those wallet holders could start to sell and this would crash the price of that coin or token.

- Blockchain Explorer is the easy way to find out whale activities.

- These explorers, label wallets belonging to centralized and decentralized exchanges. This can give you a sense of whether people are trading or holding those coins or tokens.

That’s all.

If you have any questions, comment below.