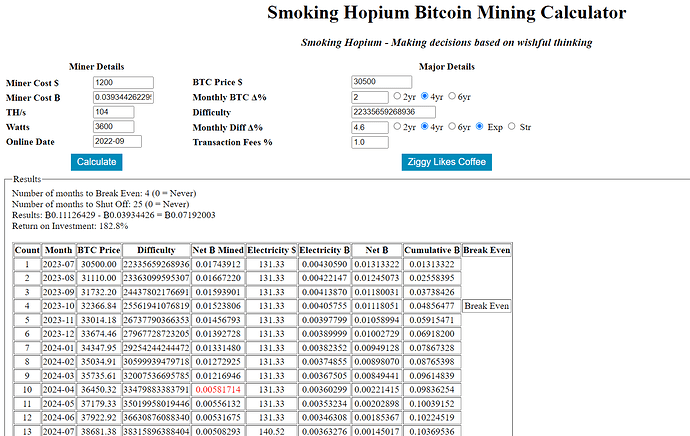

This is a super cool calculator I found someone sharing on reddit. While no one can predict the future this gives a half decent estimate of what to expect. For example, If I put in a miner cost of $1200 for 104th (that’s what it would cost for a 90th S19 shipped to my location + 7007 board to overclock using LuxOS) using 3600 watts if it went online in September at 0.05c/kw it would take 4 months to break even and 25 months before it would need to be shut off due to being unprofitable.

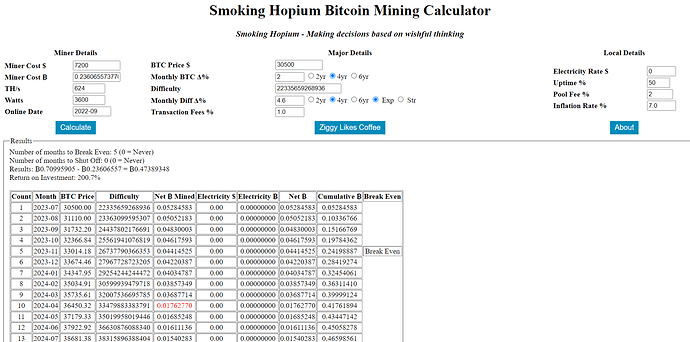

Or If I bought 6 machines using the same example except free power from solar + battery backup for 50% uptime, over 42 months it expects me to spend 0.236 BTC for a return of 0.7099 BTC

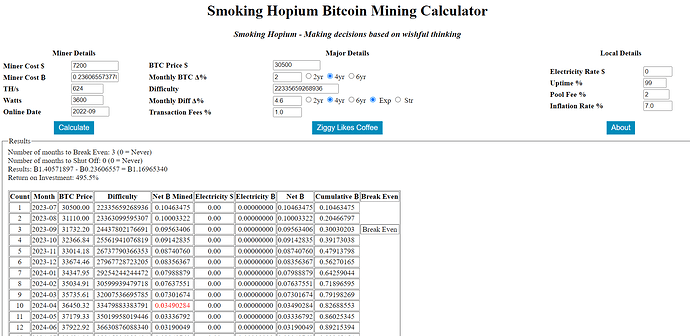

Or the same as above except running solar + battery backup/Biogas generator backup for 99% uptime I would spend 0.236 BTC for a return of 1.4 BTC after 42 months

I think this is a cool calculator because all other calculators we look at only show real time or past, in fiat, and does not account for the future difficulty rises. knowing the fiat value is anyone’s guess but at least difficulty rises is easier to expect, and you can work out if you are better off buying the coin or buying the miner