Love seeing that the price isn’t being ridiculously marked up

6300 is this final price ? With delivery ?

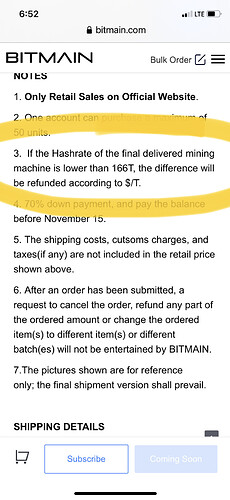

Preorder for January 2023 delivery with Bitmain lucky if you get it in March

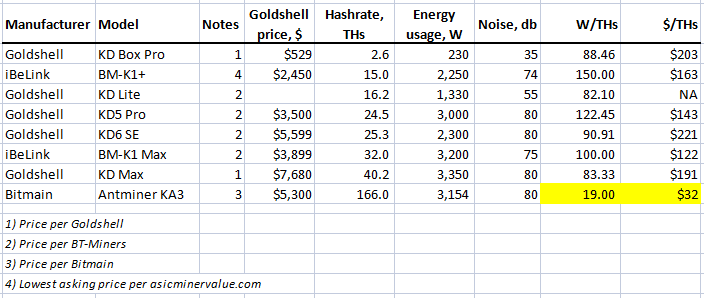

$5300 on Bitmain’s web site. I’m always suspicious of Bitmain. Yup, we’ll be lucky to receive a December delivery rig before May. And if they’re pricing the 166 THs KDA rigs at $5300, can you imagine the upcoming hashrates of future rigs? They’re probably already testing/hashing with 300 THs rigs.

you get points for not doing a ridicoulos markup, but you lose lots of points for still selling kdbox pros for over 200$ considering they will basically be paperweights by early next year assuming the market doesnt get worse.

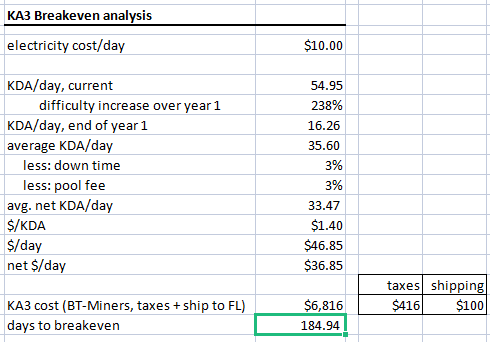

So really by the time everyone turns on their miners I’d say a ROI of 200 days (before electricity) would be realistic? I’ve never mined kda before but vosks video said $66 a day after residential electric. Does everyone else think 200 days ROI? To me that sounds fair

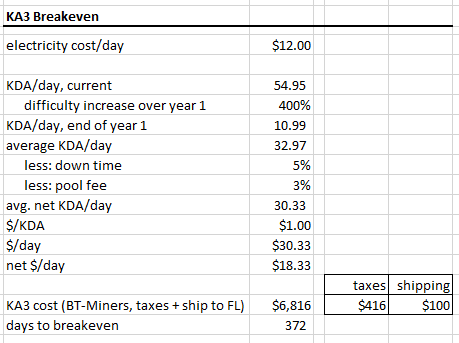

@ShredZ I think you’re in the ballpark. I tried a quick n’ dirty calc and was arriving in the sort of the same area holding current KDA price constant. But I think you baked in even more slippage, which is smart.

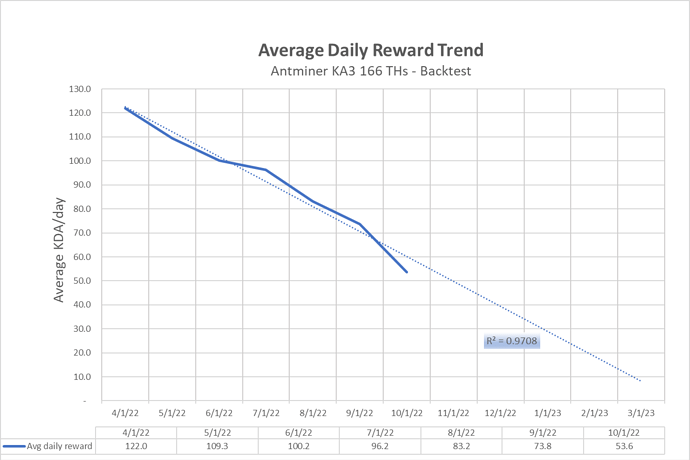

I assumed that difficulty would increase at the same rate it has over the past 6 months, annualized it, then rounded up a bit.

I also assumed purchase from BT-Miners w/tax and shipment to Florida (where I live). Electric cost is ~$0.14/kWh.

I never thought Bitmain would sell the KA3 at this price level

Very nice thank you. Did anyone else see that partnership with hash frog? If you look they’ll give you 90 days of 100T for $3300. This was before Bitmain pricing so I assumed it was going to be more expensive

The above notwithstanding, how long before Bitmain introduces the new KA3 Pro 200, then KA3 XP 250, then KA XP 300 + HYD? I’m just spitballing but they came out of the corner swinging with 166 THs. Given past history, they already have materially faster rigs in testing (and/or hashing at their own facility).

Still, one has to admire the absolute smoking speed and efficiency of the KA3. They must be using materially more advanced processor technology (e.g. 5 nm) compared to Goldshell.

This calculation seems OK !!! But If they deliver december batch by may 2023 ( it was same situation with L7 ) , I think that Goldshell and Ibelink will deliver to market something that they can fight with Bitmain and calculation will be worse !!!

But I am thinking in another way if Ibelink and Golshell decrease their prices of K1max on for example 1500 usd , or KD max on 2500 usd it will be good buy…

Nor Ibelink , nor Goldshell are selling this machines everybody is waiting to see what will be with Bitmain…

And I also think that KDA will hit 1.1 usd price buy end of year , probably price of BTC will pull KDA price down… BTC is strugleing on 18.5 K currently and KDA on 1.35-1.4 if they breach that support levels i think if you get KA3 for free it would not have any value…

Unfortunalty , I hold lot of KDA , and mine KDA…

I don’t think that Goldshell or iBeLink have anything now or in the near future that will be able to touch the KA3’s efficiency.

A good example is the Antminer L7. Has iBeLink been able to counter the L7? Nope. Goldshell? Nope. Sure, Goldshell has the LT6 and LT Lite but neither are profitable now at typical residential electric rates. Rates would have to drop to <$0.11/kWh just for an LT6 to be breaking even - at today’s LTC/DOGE prices. And by the time an LT6 breaks even, an L7 9.16 would be pulling in $14/day after electric costs.

IMO, Bitmain’s processors appear to be a technological leap ahead of Goldshell’s or iBeLink’s. It’s like the latter are bringing knives to Bitmain’s gunfight.

I’ll also be surprised if Bitmain is able to ship the December batch remotely close to on time based on my personal L7 experience.

Yea I asked same kinda question yesterday in discord and a regular said same thing which I didn’t notice till he brought it up. Bitmain is way ahead of the other in chips it looks like. Just like you said the L7 crushed and killed any other ltc miner

Thank you for the quick caluculations, I was aiming to do that tonight for myself. My only concern is the difficulty on the network once these KA3’s are in place. It will increase the ROI days unless the price does a U-turn which seems to be very unlikely given the macro situation. Any additional thoughts , my hands are really itchy to get one but my brain is just asking me double / tripple think before deciding to buy one

@SandeepKarnati Over the past 6 mos, difficulty has increased by over 128%. In the version of the table that I posted previously, I assumed a 238% increase on a year-over-year basis. Admittedly, this likely will prove low if my theory that the KA3 166 THs rig is likely a KDA “introductory” miner for Bitmain, with higher hash models yet to be announced. So in retrospect, I probably should’ve just rounded to 300% (or higher?) and called it a day.

So let’s stress it a bit. I increased electricity costs. I also assumed a 400% difficulty increase year-over-year, increased downtime to 5%, and assumed an average KDA price of $1.00. Still, I’m getting just over a 1-year ROI, which is quite reasonable.

I get that it’s an oversimplified calculation. E.g, it’s unlikely that difficulty will increase linearly. But without being able to predict the difficulty curve, it’s a reasonable representation absent better info. Also, KDA pricing will be all over the map. Breakeven is very sensitive to price and hold vs sell decisions.

And if I were to play with the calculation a bit more, I’d assume that Bitmain won’t deliver December rigs until March 1st, i.e. start with a KA3 mining perhaps ~35 KDA/day by the time us plebes take delivery and then project 1-year forward.

I’m in the same place that you’re at. I can take the plunge and upgrade my KD5s with two KA3s. Or watch the KD5s go negative returns over the next 2-4 months and essentially exit KDA mining. Unfortunately, neither of us has a crystal ball.

So true, I was thinking the same w.r.t difficulty. It’s not linear but with the way and the pace the mining rigs are being setup currently , the difficulty will be shot up in no time and thank you for the cal with 400 % increase that sounds very reasonable considering the 166TH being available from Dec for large mining groups and as you said we should be lucky to get our hands on one in Dec/Jan and Feb/Mar seems to be a likely delivery if ordered now.

Only If I had the crystal ball, I will be not be buying the bloddy box miner for 5K-6K each ( looking back at it now, it’s exactly 100 times more TH than the original box miner  )

)

Ho well, it feels like cat and mouse , if we don’t jump in now we will loose for scalping prices later if KDA pumps up ( assuming the market reversal ) and if not it’s an another oblivion waiting for us

Yeah I looked at it, for 160T they are offering it for close to 7k for 120 days which is not at all profitable unless the price of KA3 drops dramatically or goes -ve or the price of KDA tanks ( in this case even the 120 days hashrate profit is not fully realised ). Hope I got this right

For those interested . . . below is avg KDA/day per minerstat.com, which I curve fit and projected forward. Unfortunately, they don’t publish raw data. So I simplified by picking the 1st of each month dating back to 4/1/22, which is as far back as they go. I tried a couple of curve fits but a linear fit seemed most reasonable over time.

So anyone considering a KA3 probably wants to consider future yields, electricity costs trends, and their own personal view on probable KDA pricing trends. If you run through the numbers, should KDA trade sideways for a while, it might take years for a KA3 to break even.

Note that for a KA3 rig shipping in mid to late December (fwiw, they were 5 months late with my L7), if Bitmain is only 2 months late delivering, then KDA/day starting point would be ~20/day compared to the ~54/day currently. Then bake in an annual 250% increase in difficulty over the subsequent year and that KA3 would be producing ~5.5-6.0 KDA/day by 2/1/24. Unless KDA is >$2 by then, most people wouldn’t even be able to cover their daily cost of electricity.

Gee wiz dad. Thanks for taking the time and effort to show us the potential risks of buying this miner. This gives a better explanation of why it is priced so low. Much appreciated legend