What are all the Kadena exchange or wallet options? My KuCoin KDA wallet has been under maintenance for over a week and KuCoin support has no time frame.

I personally leave them on an exchange. If you want to take them out, you can try zelcore wallet.

If your located in USA, besides Kucoin, these are other exchanges that work,

- CoinMetro (Never had wallet maintenance with CoinMetro)

- Okcoin (Works perfect with Koinly, but also has wallet maintenance ever so often. But KDA always deposited after wallet maintenance was done.)

- Bittrex USA (I have not used this exchange)

And Coinex supports KDA too, but I’ve never used them either for KDA…

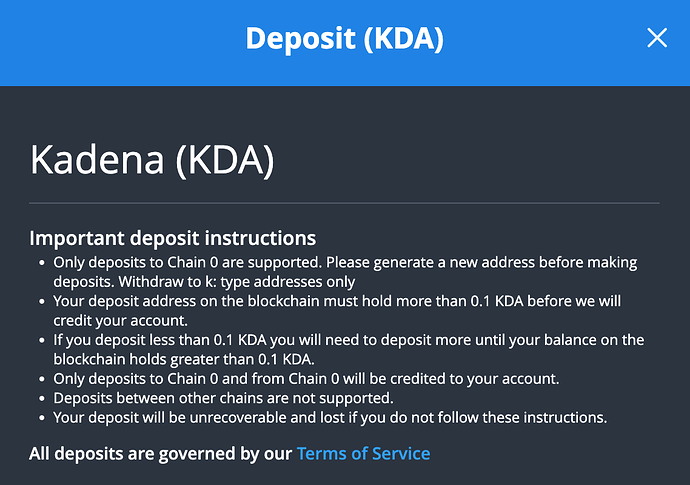

My concern with depositing Kadena KDA into Bittrex is their lack of chain support, it’s on my to test list, but dxpool states

" * 5.KDA withdrawal needs to confirm the chain number, transfer assets with different chain numbers will not be retrieved, the chain number of the mining pool is 0" so it should work…

I have been using Zelcore. I run my profits into 0 chain under “mining”. It’s more of a pain having to swap, then transfer to a centralized wallet if you want to cash out but so far has done me ok

I’m just chiming in with my KDA wallet preference. I like TradeOgre.com (exchange). They are no-KYC and simple/easy to use.

TradeOgre specializes in mined Coins/Tokens, they are the miners Exchange.

Personally I really like TradeOgre been their since 2017, zero issues. Held over 3 BTC at certain times. Mined over 40 types of coins into the exchange. So for a no-KYC / minimal devs/admin , I trust them to that extent and am happy with the service they provide me.

Thanks everyone!! Set up a coin metro account and works great! Thanks for all your help!

does zelcore support kda for in-wallet swaps?

fun fact gemini exchange flagged my account and interrogated me after depositing some eth and btc from tradeogre in 2019 – they questioned me about high-risk exchanges in 2021, after a ton of back and forth they named tradeogre and hotbit… which I used to trade some mined coins for btc/eth…

They sure do! When I want to cash out my KDA to pay for electric and business expenses, I swap it for the appropriate amount in LTC and then transfer to BlockFi, from there I swap LTC for GUSD, then transfer to business checking.

My only beef with Zelcore, is it does not export perfect excel files to import into Koinly or another tax program. I always had to fix mistakes or missing transactions from Zelcore…. In Koinly.

I’d rather have minimum manual entries into my tax program…. Hence why I use Okcoin…. When I feel like it, I move a set amount of KDA to a wallet if I want full control of some of my KDA. But for the day to day mining deposits and sell or buy orders…. Okcoin syncs perfectly with Koinly = a lot less work later…

Kucoin is fine for KDA, when it works. They’re frequently performing “upgrades”, which can cause KDA to be locked up for a couple of weeks while they update wallets.

I tend to keep very little on exchanges. Most of my crypto is held in a Ledger or within software wallets. My KDA is held on Zelcore as Ledger and most software wallets can’t accommodate KDA for the time being. The one exception is XWallet, though I’ve only used it for test amounts. Frankly, I can’t see the advantage of XWallet over Zelcore (maybe there’s something I’m missing?) - though Xwallet facilitates KDA <===> FLUX swaps on Kaddex.

Fwiw, Zelcore used to suck, badly. Up until the past 4-5 months, it had been very buggy. Now, they’ve made enough fixes where it’s halfway decent. Zelcore also is a good wallet for FLUX (saving up for a Nimbus node). By simply holding FLUX in Zelcore, it qualifies for the occasional airdrop (e.g. FLUX-AVAX and FLUX-LUNA).

I have a Coinmetro account. My experience is mixed. I had to go through KYC several times before they actually fully permissioned my account. And the requests were drip fed. I first opened the account and KYC’d. They permissioned my account for several months before freezing it unannounced. When I contacted Coinmetro, they said they needed my passport/license pics plus a selfie, which had already been provided previously during the first KYC process. They (politely) made me resubmit despite my protests. After resubmission, CM unfroze my account.

A couple of weeks after, they re-froze my account again (not notice) and asked for address verification. One of the valid docs for this was a utility bill. So I downloaded a PDF from my electric co’s site and forwarded it to on. Several days later, my account remained frozen. I reached out to support and their response was that KYC dept. didn’t believe that it was a real US utility bill. I asked them the basis of their assertion since I didn’t think that a bunch of Estonians were able to determine the veracity of a US utility bill. Finally, they relented and unfroze my account after which I promptly x’ferred all assets off the exchange. I will never use CM again due to their propensity to freeze assets (another reason to keep your coins off any exchange).

Bottom line . . . IMO, CM is a mixed bag. When you do contact customer service, they’re very responsive and very polite. But expect that there’s a possibility that you could wind up in KYC hell. Their trading fees also aren’t cheap.

FYI,

If you don’t use a VPN when using CoinMetro, than you have nothing to fear about them freezing your account all of suddenly.

I’ve had no issues with CoinMetro. Besides, Fees may be higher, and CoinMetro does not always play nice with your Tax program. I’ve always had small errors when importing CoinMetro files into Koinly, due to CoinMetro’s rounding and not logging complete transactions….

I don’t use CoinMetro much because it adds extra work when it comes to taxes…

I view that as political crypto.

Not like, How much bitcorn does a warhead hold or how the FBI gave The Ukraine 215 BTC which Silvergate capital cashed out for them in Germany so they could buy US weaponry off of Germany so the US could justify spending and order more supplies to refill what they “gave Germany”. That’s just Politics.

I’m referring to the moral debate started in 2015 about if Tokens could be considered crypto at all since they directly went against Satoshi Vision by allowing a small group of people to print unlimited amounts of unbacked tokens and steal value from BTC like BTC steals value from fiat. The topic kind of fizzed away in 2017 when tons of new Networks popped up. But the embers still simmer. Back then Gemini and Apollo took a stance, they would prefer tokens over coins (if you remember, Apollo would only pair XRP/ to crypto, not BTC and not the “other token” USDT) . Tradeogre was the flipside. Tradeogre would stick with Coins or ‘people mined’ crypto. Thus started a massive PR campaign to slander Tradeogre that hasn’t stopped yet. They started by creating website’s to make Tradeogre seems like a scam. They questioned Tradeogre’s integrity and trustworthiness. Any human comment/testimonial about TradeOgre is great. Zero issues. TradeOgre is just one of the victims of this. Today Gemini and Coinbase have cornered the market on token propaganda. They own CoinDesk and other online crypto news, as well as have an army of “pro token” shills across social media’s. Things like J.P. Morgan buying controlling interest in MetaMask and cutting off users in Venezuela, Iran and N. Korea to enforce US sanctions is a mash up of Political crypto and Politics. The Token crowd want Stable’s only based off of Green Back value/green back standard.

This all leads to why they would question you. They have put too much money and effort into villainizing Coin Exchanges. I can’t imagine that effort would stop with you, in fact they would double down. If they can force Vosk to conform with there tax bullshh, then they can force anyone.

And really, it’s not those exchanges per say. It’s Silvergate Capital, SSgA, Blackrock and EJF or more so their face company VISA in conjunction with the US government. Since Silvergate banks for those exchanges and VISA processes the cash in/out transactions.

I have the same issue with Bitcoin USA and CoinFlip . I live from BTC ATM’s, I don’t use banks (that could be counter productive and a slap in Satoshi’s face). Numerous times they’ve held up my transactions, only when they come from TradeOgre. And I get it, those companies use Coinbase and Gemini to quickly move the crypto I am selling to them. So when I send them crypto it actually goes to Coinbase/Gemini and gets flagged. The ATM companies will not tell me what went wrong. But they know me, personally and as a business partner. The people I talk to and know with them tell me they don’t understand why and they’ve never seen the computer system freeze like it does with me. I totally get it, I mine LTC with US dollars, then take that value (that day) and turn it into more cash than I paid to mine… and my country is having a hard time printing enough cash to replace the value I stole XD, so they are trying to stop it. Not by banning it, but by convincing the next generation that Stable coins backed by Greenbacks will make them $$millionaires$$ (bling bling), I mean even you have to admit that Smoking Monkey is pretty fucken cool.

I know about as much of the anon TradeOgre Admin as the rest of the world. But from the depths of my crypto heart, I admire them.

From 2018-2021 Trade ogre didn’t do much. They stayed alive and rarely added new Coins. In late 2021… something changed… They all the sudden started adding any/all coins (“mined”) they could find to add. In a time in the world when tokenization is creating more issue than fiat, it is refreshing to know that a couple devs/admin out there are willing to put their feet down and stand up for decentralized coin mining done by the average everyday normal motherfucker. In my view, crypto should be able to help me equally to a poor child in a 3rd world nation, tokens will not do that, they will create more poverty by empowering the already financially powerful.

And yeah, I know I blab a lot and I have a biased opinion. (my opinions come from you, from those small things you don’t say and instead say “you know” and have a little mixed frown, I know what you mean, “Satoshi Vision or bust, no compromise”)

Not true. At first, I did use a VPN, which by doing so I unknowingly violated their policies. So when they first froze the account, it was for KYC issues. When I argued with them, they then mentioned VPN in their email response to my retort to KYC’ing . . . again. And even after shutting off the VPN, they still froze my account because of the later request for proof of address.

And not for anything, but I had used a VPN for months with Coinmetro without a single problem (and after having provided them with 1st round of requested KYC info) until and without warning they decided it was a problem.

I’ve only provided my experience with them. They’ve shown that they’re way too willing to freeze my assets for my taste. If I’m the exception and for others Coinmetro has been flawless, that’s great. But I’m no longer willing to take the chance.

I will concede that their customer support is responsive and polite/apologetic. So kudos for at least that.

Roger, totally understand your hesitation with CoinMetro after all you have been through with them…