The TL;DR is that the MXC Foundation has converted without consent all user MXC tokens earned or deposited in DataDash app (DD) to xMXC tokens, causing an irreparable 75%+ loss in value. Further, there are no timelines or plans to return any of the BTC or DHX earned or stored on the DataDash app back to users. In my opinion, this is the final stages of the exit scam before the team abandons project completely and users who invested in mining rigs will be left with nothing (details below).

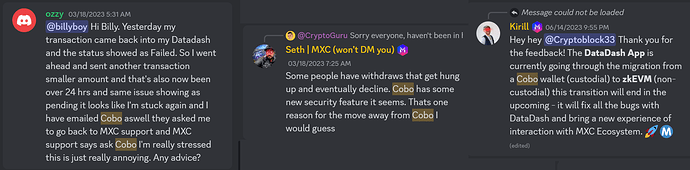

At the beginning of 2023, many users began reporting issues with withdrawing MXC tokens out of the DataDash app. MXC staff members claimed that this was outside of their control and enforced by their custodial wallet provider, Cobo. Staff said that there were new know your customer (KYC) / anti-money laundering (AML) requirements for withdrawals over a certain amount. The resolution was for users either to wait for a transition to a fully on-chain mining solution to be released (zkEVM) or to communicate with support to produce onerous amounts of documentation to prove they owned these coins. Many who tried to comply with this second method were eventually ghosted or ignored by support and never able to withdraw.

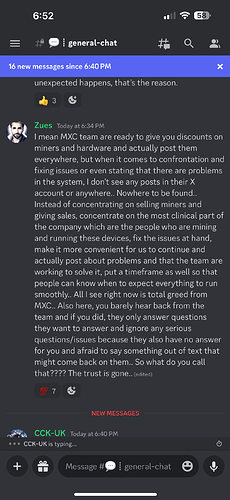

Image 1: example of a user (ozzy) having a withdraw issue, and staff blaming new Cobo KYC / anti-money laundering policies

MXC Foundation planned a solution: to migrate all centralized DataDash activity (mining, staking, depositing, withdrawing, etc) to a decentralized, fully on-chain experience. The team developed what was marketed as “the first L3 public chain on Arbitrum,” which would give “self-custody and freedom in YOUR hands…your tokens, your control.” Additionally, the zkEVM technology was promised to bring “ultra-low fees.”

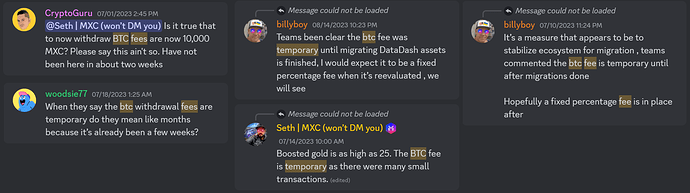

Around the same time, MXC Foundation arbitrarily raised the BTC withdrawal fee in DD app from 500 MXC (~$6) to 10,000 MXC (~$120). This was described as a temporary measure until migration to zkEVM was completed. However, it had the effect of essentially blocking most users from withdrawing BTC because most users didn’t even “mine” enough BTC to cover the new $120 fee. Who would want to initiate a withdraw that would cost more than they earned?

Image 2: user & staff discussion around new, ultra-high BTC withdraw fee.

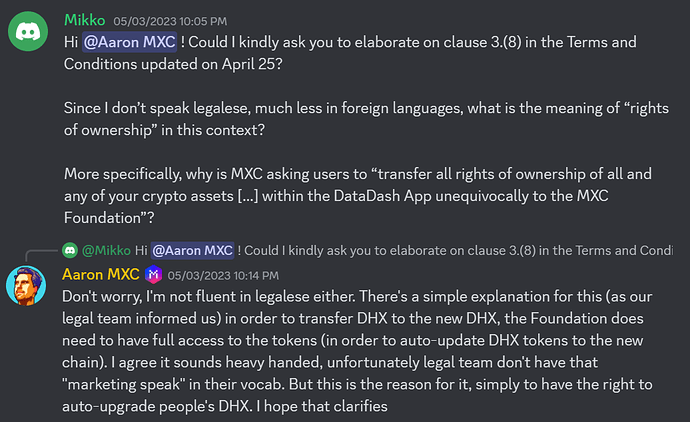

Furthermore, MXC Foundation quietly updated the Terms and Conditions on their website to include the following language: “by using the DataDash App you agree to transfer all rights of ownership of all and any of your crypto assets by storing, depositing, staking, holding, mining or any other form of usage within the DataDash App unequivocally to the MXC Foundation.” [emphasis is my own; note language has now changed from DataDash → AXS]. Staff blamed the required “legalese” change on DHX migration. (Note further that while they updated the website ToS, they have failed to update their market cap on their website from $220mm to current value of only $21mm…)

Image 3: unconvincing explanation of terms of service change by Aaron, co-founder/COO

With many users stuck in centralized token control limbo, everyone was anxiously awaiting the migration to decentralized zkEVM. In a marketing email ahead of transition, the team wrote: “as part of MXC’s commitment to a full–scale decentralized rollout of the MXC zkEVM Layer 3 blockchain, all DataDash accounts are eligible for a complete balance migration from the DataDash mobile application to the MXC zkEVM Layer 3.” [emphasis my own]. Even on the official migration form, the MXC Foundation states that “Upon withdrawal [from DataDash to zkEVM wallet], the MXC tokens will be converted into an equivalent form based on the MXC zkEVM blockchain…By filling out this form, the User agrees to receive all the tokens and waives all future rights.”

A reasonable person would assume that if they had 100 MXC tokens in the DataDash app, they would receive 100 MXC tokens in the zkEVM L3 wallet, as well as their DHX and BTC balances.

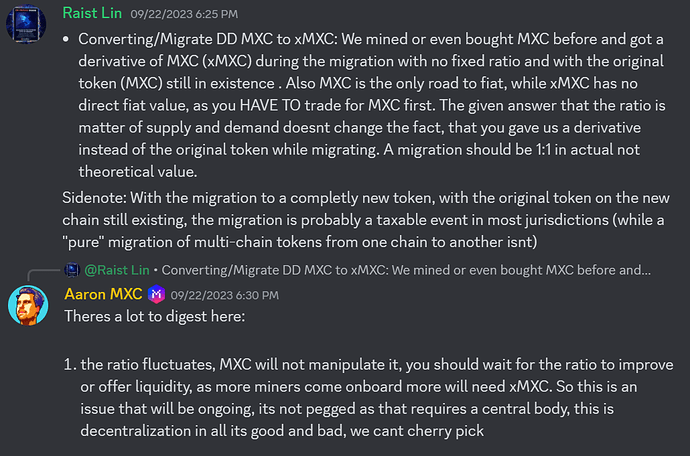

WRONG! First, MXC has delayed indefinitely any transfer of DHX or BTC from DataDash to zkEVM. Second, users were shocked to discover that they were given 1 xMXC token in their zkEVM wallet for every 1 real MXC token in their DataDash app. Further, the only avenue provided for conversion of xMXC back to MXC is a volatile asset swap (i.e. not a pegged / stable swap) with only ~$24,000 of total pair liquidity or approx 1,250,000 tokens each of both xMXC & MXC. This meant that only the initial few users were able to recoup a majority of their MXC tokens, as the swap price immediately plummeted to the current ratio of 5 xMXC for only 1 MXC. This means that a user with 100,000 MXC in DataDash is left with only ~20,000 MXC they can withdraw from zkEVM

Image 4: currently 100,000 of migrated xMXC is worth only about 20,000 real MXC, along with historical graph showing price is mostly in the 0.2-0.4 range, or a 60-80% loss to users

When confronted about this unexpected conversion to xMXC, co-founder and COO of MXC, Aaron Wagener, stated that MXC has no intentions of pegging xMXC : MXC at 1:1 even though they forced ALL USERS to convert at this rate. “We can’t cherry pick” is his excuse, although they randomly cherry picked this conversion without consent.

Image 5: co-founder’s response to concerns by users on forced conversion of MXC to xMXC at 1:1 ratio

Furthermore, the MXC Foundation has always tried to differentiate itself by marketing its Proof of Participation (PoP) Multi-token mining capabilities. They’ve historically discussed the ability to mine MXC, BTC, DOT, & DOGE, although DOT and DOGE were never implemented. With this transition, miners are no longer able to mine any of these well-known tokens, however, are limited to mining completely unknown tokens called SENSOR, GIN1689, CRAB, and/or MAXIS. There have been NO INFORMATION about what any of these tokens are or what utility they are supposed to have, even though the team encourages users to “DYOR.”

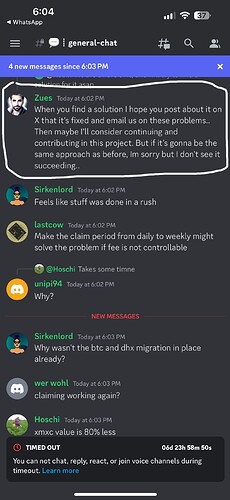

Image 6: staff communication around BTC/DHX balances not transferring, the end of BTC mining, and the beginning of ISO token mining

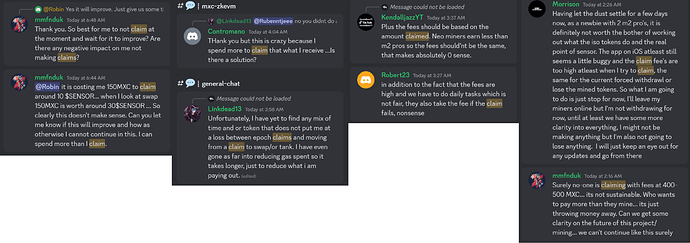

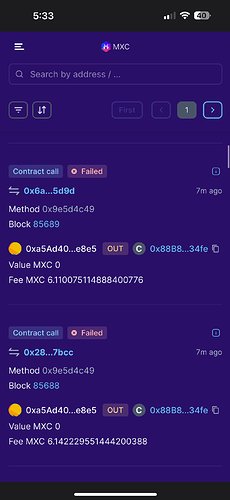

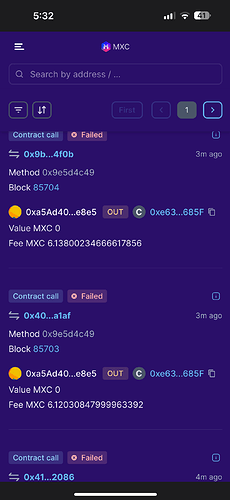

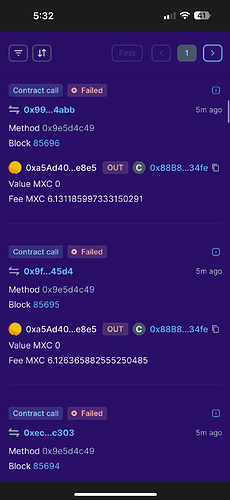

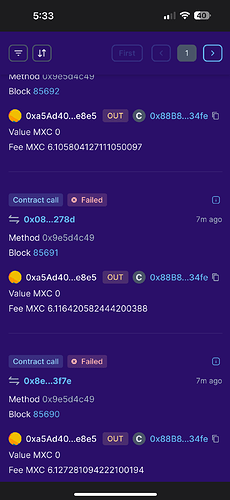

The team has further completely changed the PoP requirements as part of this transition. Users are required to manually “claim” their mined SENSOR + ISO tokens every 24 hours, otherwise, their earnings will be distributed back into the pool. On top of this, for the majority of users, the claim function has an associated gas fee of 100-250 MXC tokens = ~$1.00-2.50, which 1.) isn’t “ultra-low fee” as you would expect from a L3 solution and 2.) more importantly, is usually MORE in fee than is EARNED in the claim (when converting tokens to MXC at market swap rates). IT IS LITERALLY UNPROFITABLE TO MINE ANY TOKENS AFTER THE TRANSITION.

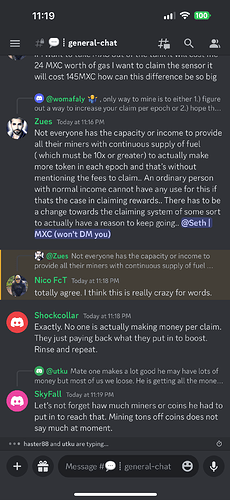

Image 7: a few samples of users noticing that the MXC gas fees are > value of the tokens mined

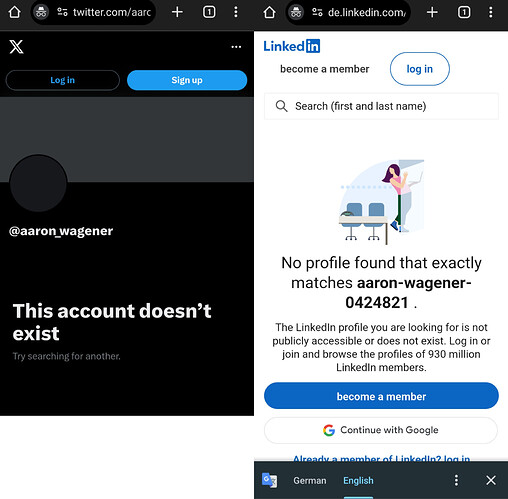

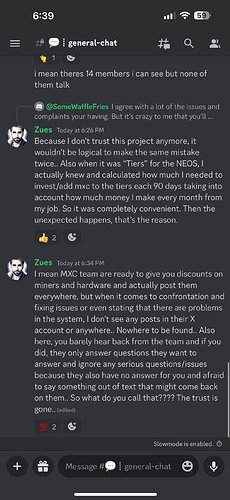

Finally, out of nowhere, Aaron Wagener–the co-founder & COO of MXC Foundation and the founder of MatchX–has deleted his entire Twitter profile page and his professional LinkedIn profile. This is a huge red flag ![]() and no team members on Discord will address why.

and no team members on Discord will address why.

Image 8: Aaron Wagener is purging his online profiles

There were many other issues with the transition, including many users not initially receiving their full amount of MXC and others reporting discrepancies in mining rates for equivalent miners. But it seems clear to me that the MXC Foundation has begun to abandon their user base that has supported their proposed network, and in the process, has retained control of a majority of user MXC, DHX, and BTC assets. I hope to be proven wrong, but it appears that users who bought $2,500 m2pro or $500 NEO “mining” equipment will be left empty handed.