CEFI is pretty strange term, but it comes out as normal definition after DEFI, since companies that runs CEFI projects/websites are centralized and registered as fiscal entities. DEFI on paper have all possible advantage and the major one that will everybody point out is “You hold your own keys”. That is completely true. On other hand, reality is that there are more and more scams in DEFI space, since there is zero control of who is running those DEFI projects and zero due diligence before they get listed usually on uniswap. With CEFI there is a different picture, and those projects are companies, backed up by funds from institutions and having large amount of assets under management. I started putting some of my coins, mainly BTC and ETH back in 2018, and I will share now with you some of my experience. In any case, this is my experience, my way and I am not giving you any type of financial advice. The only advice I will share with you is that you NEVER EVER put all your assets in ANY project, no meter how good it is and how good income it provides. 40% was and stays max that I ever put outside my own ledger wallets.

I will start with crypto com, they are the oldest, and as they state, they are biggest if you count customers – like 5 million. I personally do not believe it is that much, but I am fairly sure that they have more members than other CEFI platforms. I started there by end of 2018, when they were still MONACO (MCO). I heard by that time that they purchased domain crypto com few months before me joining and I saw that as bold and long term move. I did not start there to earn interest, I wanted to have their MCO atm card. And I get my pretty fast delivered to my office in Singapore. I am Irish, early retired in Thailand, and I have few offices across Asia and EU. Crypto com did not have crypto interest accounts until May 2019, and it was not well accepted with members, since they offered just locked options, 1 and 3 months. After that test, week later, they presented to some of us via email their FLEXIBLE term rates, just for BTC,ETH,PAX,TUSD,LTC and XRP. APY% was pretty low, 2% and 4% if you hold MCO token. I tested it, it worked fine, and steady 4% was nice at time. Six months later, they start to throttle, my interest earnings were late or in few times inaccurate, when I write to support it was always longer than 48h, sometimes whole week until they reply – which is unacceptable. I removed my coins from interest accounts and leave just enough MCO coins so that I can have my crypto card operational. I am still using crypto com atm card, it is now backed up with CRO token, even the name is still MCO.

Things I like about crypto com: Their atm card – the only one currently working from CEFI platforms. Mobile app looks very nice and it is by far best mobile app from all CEFI platforms. Long in business and legit.

Things I do not like about crypto com: They slow support response, more than 48h and sometimes whole week. Their registration country – Malta – my lawyers tell me it is hard to sue and win any Malta based business in case of any dispute. Their low interest rates.

Second one in list will be Blockfi com. I will be short on this one, since they are pretty straight forward. I heard about them at start of 2019, they did interest accounts actually long before crypto com, in late 2018. Back then it was 6.2% APY on BTC for first 5 BTC and 2.2% after that. I started there with 5 BTC, and withdraw half, when they lower their rates to 6% for up to 2.5 BTC and 3% for more than 2.5 BTC. Blockfi is nice app, they are pretty OK at support, reply within 24h, sometimes 48h but that is really 1 in 10 case. They are legit company registered in USA, and they just announced their atm card, which I believe they will deliver in 2021 Q1.

Things I like about blockfi com: Their interest rate of 6% on BTC (up to 2.5 BTC), Their support response of 24h, rarely 48h. Their USA company registration, which allows me to chase them with my lawyers if anything goes wrong

Things I do not like about blockfi: They support just 8 coins for interest accounts, they slow withdrawal – every time it took more than 24h, one time more than 48h. They payout monthly. They allowed some clients information breach, when they get hacked back in May this year (https://www.forbes.com/sites/robertanzalone/2020/06/16/blockfi-hires-new-chief-security-officer-after-last-months-hack/?sh=13c9dbe24c57)

Third one is Celsius dot network

Celsius is biggest one my assets under management. They got audited few days ago with chain analysis, and all 3.3 billion USD AUM are confirmed. I was BIG fan of Celsius from mid 2019 till last month. There was a period when I hold and earn interest there on 12 different coins and stablecoins at a time, back in January. Then as many other services, not only crypto based, as they grow – they degrade their service quality and lose focus on core business. When I started there, back in July 2019, they were focused on crypto borrowing and interest accounts. Their CEL token was secondary thing and just a nice side earnings for those who participate. In recent days, they are 95% focused on CEL token price and how to maintain the same by pumping it on Uniswap and Liquid to keep price up. I am 100% sure if they ever get listed on Binance or Coinbase like CRO token is, CEL price will go down like a broken parachute. That is why they avoid more listings, covering it in phrase like they do not want to pay for listing – they want to share that with users. I found that funny, since now most expensive Binance listing is 50 BTC, and that is for tokens which are suspicious, for legit ones you can list between for 10-25 BTC. Celsius claim that they pay more than 2 million USD interest per week, so those 10-25 BTC will really not make any difference. Anyway, I withdraw half of my coins from there back in July this year, when I saw that my withdraw took more than 48h after me sending 3 emails to support. Rest of my assets I withdraw last month, on November 14, after they resolved their DNS “issue”. We all learned that 3.3 billion company hold their DNS records at godaddy private user account, which is cheap move. And it was scary moment when NOBODY could access their assets for almost 48h. I left some CEL token there, just to watch how long they will continue to pump. Celsius is legit company. Registered in UK, (https://find-and-update.company-information.service.gov.uk/company/11198050) . UK laws are the only one that are harder than USA laws, and there is no joking there, trust me, being Irish I know all. But there is one question I asked my lawyer about incident when I lost access to app due to DNS “issue” – in case of any of those platforms do the same, and just vanish, I am left with no hard evidence that I was holding anything there, since it was all online and via mobile access. Even if I take screenshots, they cannot proof anything, we all know screenshots can be fabricated. The only way to sue and win is if you have trail, signed paperwork, or even email full statements are ok.

Things I like about Celsius: Number of coins they support, their high APY interest rates, their low crypto borrow APR%, Their transparency

Things I do not like about Celsius: Their slow support (above 48h on average), They compound weekly and pay out weekly. Them pushing members to buy OTC their CEL token , on daily basis – look like desperate. The way where they expose everything around ONE person, Machinsky, which is completely not secure – if something happen to him, they will collapse.

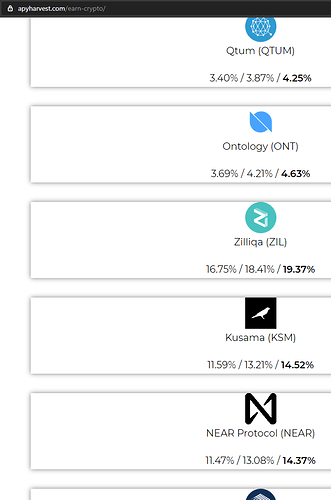

Fourth one is my current favorite, apyharvest com. I say current since this is crypto and anything anytime can change. Apyharvest do noly crypto, no fiat at all. They all calculate in USDC, not in USD. I started with them in January 2019. Back than they were harvest investment, and services and IP restricted only to UK customers. They operated just in Northern Ireland and some parts of England and Scotland. My house in Dublin was 3 streets away, and I developed pretty strong relationship there, even with few of my visits in person to their offices. They switched from harvest investment to apyharvest and opened new site apyharvest.com few months ago to start slowly spreading around world. I say slowly, since they do not do any type of marketing except referrals from their existing customer base. I have currently there more than 15 different coins, my biggest chunk is still in BTC, ETH and USDC. I mine directly there, so all my BTC, ETH, LTC and XMR rewards go directly to my miner account addresses which are permanent, and then once daily they are moved to my interest account and start earning APY% interest next day. I get all transactions on daily email reports, very precise and clear, per coin and per type of tx. Apyharvest do not offer any platform to access for end users, they main point is security – where there is no platform – there is simply nothing to be hacked. Instead of that they offer next best thing – personal crypto bankers, real persons which communicate with clients in more professional way than banks. And they are available 24/7 and I can confirm they ALLWAYS reply in less than 12h (in my case 4h on average). Every withdraw I made was also in less than 12h. Each member gets one personal crypto banker, in some cases maximum 2. I got 2 pass phases from start which I do not keep on email, and they are there for any withdraw and in case that something happens to my personal email account. Interest payments are daily, interest compound daily, and I can withdraw whatever I want whenever I want. For persons that do not like to do strong ID KYC, since they are only crypto, under UK AML law, for any transaction bellow 15000 GBP basic KYC is enough – that means Name, Surname, date of birth, phone number, Address, Country…no ID scan or ID call. For transactions above 15000 GBP you need to do KYC with photo IDs. I needed to do EDD (enhanced Due Diligence) since I reached Tier4 , which is offered ONLY to Tier3 members via their personal crypto bankers.

Apyharvest is legit, they are registered in UK (https://find-and-update.company-information.service.gov.uk/company/OC415569) , they provide clear and easy to read email statements which are good proof if you need to open a case against them on UK court.

What I like about Apyharvest: Their support which reply always in less than 12h. Their fast withdrawal which is always in less than 12h. Their high APY% rates. Their support for almost 50 coins. Their miners interest accounts. Their ability to open up to 7 close family members under one account.

What I do not like about Apyharvest: Confusion they make when they switch from harvest investment (closed to UK) to apyharvest (worldwide) – I get backup of all my communications from their new emails. Their silent approach – I try to understand why they do not advertise more (in my question about it to my personal crypto banker he reply to me that company target is to scale by not losing quality of service).

The last one I will mention there is NEXO io. I keep them for the end, since I want you to double think before open account there. I will not show you all details I have, you need to do your own research. I will show you just this: Nexo did successful ICO on March 2018, in peak of most of the ICO scams. You can see there all team in slides as pictures (https://icodrops.com/nexo/) Top names are: Kosta Kantchev, Georgi Shulev, Antoni Trenchev, Vasil Petrov, Kalin Metodiev, Kamen Trendafilov, Bilyana Christova, Plamen Todorov, Teodora Atanasova, Joro Yordanov, Boris Delev, Ivan Kostov and so on. All BULGARIANS. Now I will not have so big problem with that (even they present themselves as Swiss and UK company) – my problem and my lawyers problems are when you go to terms of service for loans and borrows – ( https://nexo.io/earn-terms , https://nexo.io/credit-terms ) you just look CLIENT section III 1.2 in both – YOU ARE NOT CITIZEN OF BULGARIA – that means Bulgarians providing services for everybody outside Bulgaria. RED FLAG. I will rest my case here.

I did not left any referral code here for any of these services. I would like VOSK to earn by referring them since he deserve it by making this nice forum for his followers.

Hope you find this info educational. Cheers.