Just wondering what others consider a goof ROI on equipment and associated costs (such as electricity). I use 18 months (1 -1/2 years) as a target. Anything less is good, more is bad. As an example, for one rig, currently, it’s just shy of 15 months (using cash value of coins mined).

In the world of business, 1 years time is standard. Anything within the third-quarter is very impressive and a solid investment. Anything past 15 months is considered risk and not a solid investment. When planned accordingly, it’s a good rule to follow. That’s what they’ll teach you when getting you BA in business as well

Miners used to be 7 to 10 months. The idea of a 2 year ROI, is a tax amortization write off. But kinda worthless since the machines are supposed to have a 3 to 5 year life.

Agreed with the ROI of 1 year for most miners. Also need to keep in mind is the market. If you are mining, don’t sell in full bear mode.

Stop considerring ROI.

What is the return on a dinner out? poop

What is the return on a night drinking? pee

What is the return on a 30k car? -$5k

What is the return on a 4k TV? 0

What is the return on a miner? +$$$

People spend their money on things that produce no income. ROI doesn’t matter. What matters is increasing income using money that otherwise would be spent producing crap.

What amazes me is people look at today. It’s not about today it’s about a year from today in my opinion. If BTC doubles in a year profit doubled and “ROI” cut in half or more. Or the people that say it’s better to invest in the coin…why bother if the ROI isn’t going to improve then coin price must not be going up.

well the faster you can cover the miner you got gpu-asic-or whatever the better, i got myself a kadena miner week ago but yet to plug it in due to issues with pci-psu -.- , if the calculations are gonna be on ill cover my cost in a year on the miner (cost me 6k due to well import taxes and other stuff), however not on miner alone but miner half of it and nother on what i could afford to spend+ saving a amount , my plan is converting it to BTC then stake it on hotbit ( is what i ended on, if anyone got a better place do indeed suggest) , and well if btc goes up alot more im in a win win

If you are only in it for the profit potential, I can’t see buying a miner with more than 9-12 mo ROI in any circumstance. Simply too many things can go wrong between purchase date and the unit paying itself back:

- Unfavorable price action (e.g., prices dump, hold steady)

- Poor unit utilization (e.g., hardware failure, shipping lead time from payment date)

- Decreased utility of hardware (i.e., superior equipment released and overall network hashrate increases)

- Project problems

Lots of people will have excuses for what you shouldn’t go along with this, but I said what I said. Supporting the project itself is perfectly fine. Speculating on price appreciation and therefore miner profitability is fine too because you are accepting the risks. But if this is only about profitability, the ROI of your unit is solely tied to its payback period. Putting your head in the sand about the economics of mining is not a viable path forward.

This post tiptoes around one of the most important points when considering whether to mine or not: value of the hardware itself.

TLDR, price of a miner is not the price of a coin AND that can be a good thing. You are buying a different asset with a different value proposition.

For example, look at the value of KD-BOX. If you bought a KD-BOX at MSRP for $3,800 back in December, the minute you had a functional unit in your hands it was worth $7,200-7,800. Since then, the value has declined to about $6,000, but if you bought KDA directly on the same timeframes, you’d be sitting on a really sweet 35% loss.

So it’s a multidimensional situation that you have to analyze here. It’s not easy. But there are elements to mining that “no miners” don’t consider that are in your favor. Similarly, tax situation is likely better since you can write your equipment to $0 and hold mined coins until long-term treatment kicks in.

If you are concerned about roi, go for btc miners. They are the best with steady roi, everything else is a rollercoaster you need to endure

Mining is a way to dollar cost average invest in a long term manner. We did not Buy KDA at 14 cents.

A capitol intensive new start up business ROI’s in something more like 3-5 years. Since financing of crypto mining equipment is nearly non existent, entire start up costs are on you. What bothers me most about ASIC mining equipment prices is the manufacturer charging well over normal profit margins. They are entitled to lucrative margins but they are going beyond that by asking for part of your profits up front when buying a machine from them. Pricing machines according to profit potential is at the very least, un ethical. I hope when Intel starts producing chips (and hopefully ASIC machines), we will see normalcy return to prices.

3-5 years for a ROI? What school or firm taught you that? Forecasting to basically be in debt 3-5 years before you even turn a profit is not only a poor business plan but also a quick road to being bankrupt, lmao. I hope you’re not a financial advisor

RetroParc, I didn’t say that 3-5 year ROI did not come without additional profitability. Return on investment is just that, return of capital used to start the business. Overall profitability of the enterprise extends beyond just recovering initial investment, or rather, it better or the enterprise fails. So, if you define total net enterprise profit as ROI then yes, you could probably see a one year payback. This, however, has not been the metric I have used for over 50 successful years in business.

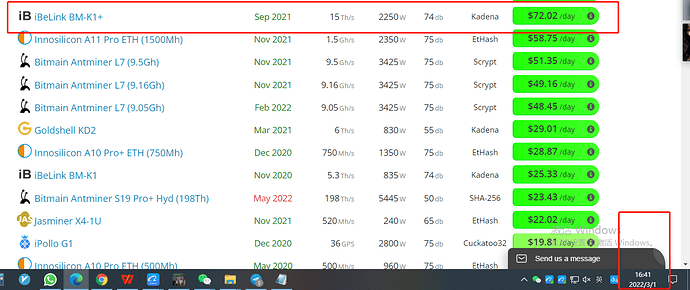

if your ROI’s target is 1.5years, as current coin price, you have lots of options. such as Antminer, whatsminer, avalonmine, Ibelink K1+ 15th, etc.

for example, Ibelink K1+, latest daily profit 72usd. stock K1+ 30k usd per unit. ROI days within 18 month, are you interested in it?

I think a lot of folks mining look at ‘ROI’ in the totally wrong way – mining offers a unique opportunity to own an asset that can generate income without actually depreciating, or if so, pretty minimally compared to a conventional business (I own a machine shop, so totally knowledgeable in that area…).

Given that unique factor, saying it takes, for example, 18 months for a K1+ to make $30k back is short sighted. It is likely that in 18 months, or anywhere along the way, you’d be able to sell your K1+ for what you paid, or within lets say, 80% of that initial investment. All the ROI talk above assumes the asset is valueless at month 18 when you ‘ROI’…and we all know it isn’t.

Therefore, I submit that you still have your capital but you just aren’t liquid which is in turn the opportunity cost for being able to mine and generate another form of income. For instance, using the K1+ again – lets say you buy one and plan to sell it at month 18. You bought the miner for $30k. You will make ~10 KDA per day, reducing to ~7KDA per day over that time, linearly. Being super lazy at 1AM, lets call it an average of 8.5 KDA a day for 18 months = ~4,590 KDA valued at a daily average value of, lets say $15USD; that gives you $68,850 in hand. You will likely be able to sell your miner at month 18 for 80% of what you paid at $24k (may or may not be true…) but either way – hopefully I am making my point clear…your investment in the machine is never really lost until the machine is close to or can’t clear its electrical costs and then no one wants it. Thoughts?

Investment ALWAYS carries the risk of lost. That is true for all: stock, real estate, businesses, especially true for crypto/mining. The general consensus is about 12 months for ROI. And yes your hardware in the 1st year still good sell for decent amount.

Honestly, you could argued a “good” timeframe for ROI is “X” and all other factors. But ultimately, its your money. If you are comfortable and believe in it, it will be an experience. I enjoyed my mining experience. The struggle of networking, the setting up of wallets, the troubleshooting of miners. And the daily deposits  .

.

I meant, people buy $10 drinks and $11 pack of cigarettes’ (NY prices). In my eyes, where is the ROI on that? But for the people who enjoys it, it’s all that matters.