I sure as hell hope so. With any luck, they’ll follow their L7 model by promising Nov/Dec delivery and actually shipping in late Feb/Mar. Otherwise, my KD5’s and KD Lite will become expensive space heaters before I even need heat.

I just hope you roi on that kd5 before they start feel sorry for all that spent 40k for them

I ROI’d on them by the end of last Dec. That’s not the issue. I had planned on getting 2-3 yrs of value from those rigs. If KA3 rigs start shipping soon, I’ll be lucky to get another 3 months from them

That said, I do have a KD Lite bought directly from Goldshell where it’s looking increasingly unlikely that I’ll breakeven before daily operating costs exceeds daily revenues . . . . unless KDA does some sort of moonshot (during a bear market)

I would think truthfully unless your mining btc your not going to get years out of those asic they make new models way to quick and way more powerful and looks like they have no plan of stopping. But glad u atleast roi on that expensive kd5

Today, you’re right. However, back when I bought the KD5’s, Goldshell had produced the KD2 a couple of years prior as well as the KD Box miner, which wasn’t much of hashrate threat. And iBeLink had a KDA rig out there. So I had thought I’d get 2-3 years of profitable KD5 hashing. Oops.

Since then, it’s been KD6, KD6 SE, KD Max, KD Lite, KD5 Pro, KD BOX Pro . . . and who knows what’s next from Goldshell once they react to the Antminer KA3

Looks like a scam!

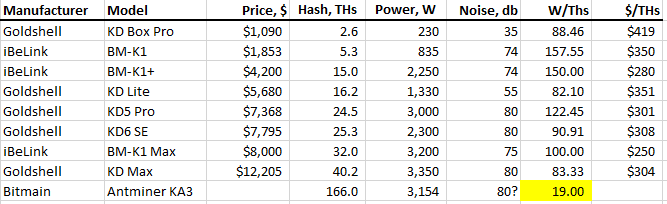

Thought I’d post an update (and eliminate some of the older rigs). iBeLink prices represent the lowest reseller pricing.

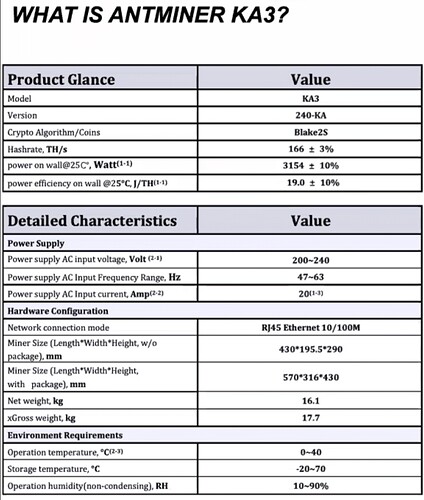

The efficiency of the KA3 is a bit unreal relative to Goldshell and iBeLink KDA rigs, though I noticed that it has a wide power consumption tolerance band, i.e. 3154W +/- 10% (2840W to 3469W range) vs +/-5% for a KD Max. But at 166 THs +/-3%, I wouldn’t kick it out of my garage for eating crackers.

It’ll be interesting - and this is an understatement - to see Bitmain’s introductory retail price

If you go off goldshell kd max price bitmain will be around 45k and today prices that’s around 30k a year so year and half roi sounds about right

I get your math but I don’t think that they’ll price it that high. As soon as enough KA3s start hashing, difficulty will spike and yield/day will drop precipitously. I believe that the pricing will reflect some of the expected yield drop.

Per Kadena mining calculator - Blake (2s-Kadena) ⛏️ | minerstat, KDA global hashrate currently is 379.14 PHs. Each KA3 rig represents 166 THs, i.e. 0.166 PHs, or 0.0438% of current global hashrate. So if Bitmain were to produce/sell ~2300 KA3s to retail mom & pop miners, global hashrate would double. And though it’s not a perfect linear relationship, one would expect the Blake2S algo to increase difficulty proportionally with the change in global hashrate. And assuming they can source chips, 2300 ASIC rigs is nothing for Bitmain.

if a few of the crypto mining companies such as CleanSpark, Hut8 etc. (let alone bigger boys such as Marathon, Hive, Riot) decide to diversify their mining portfolios away from just BTC (or just BTC and ETH, since ETH is going PoS) and into a some KDA rigs (I’d assume that Bitmain sales reps will be trying to cross sell KA3 rigs with S19 series), then future global hashrate (and difficulty) would increase by many multiples vs current. This is great for Kadena, but bad for small KDA miners who already own some KDA rigs.

Point being that just like when all the KD5s and KD6s finally were lit and hashing, yield/day dropped considerably . . . as it continues to this day with more KD Max and KD6 SEs lighting up. IMO, the impact will be even greater with the KA3s. That rig is a beast. It leapfrogs everything else from Goldshell and iBeLink.

And you just know that Bitmain is already testing ~180T, ~190THs, and ~200THs units to be released over the next year. Couple that with Bitmain’s much higher production capacity compared to Goldshell and iBeLink combined, and the future looks bleak for KDA mining unless one upgrades. This has always been the case, though to me, it seems as though rig obsolescence is moving faster now than it did in the past.

To me it just seem to be kd miner moving in a alarming rate your rig are are outdated in a few months no real time to mine on them then flip for newer model. Where btc you figure you have a year before a major jump in hashrate not taking about sub models more like S15 S17 to the S19 which atleast gives you some breathing room.that’s the whole point of mining profitable is staying current which is nearly impossible with kd miner at this point my opinion

i kinda given up mining KDA tbh ,i am better off buying the coin vs mining, the leap on difficulty is gonna spike so hard that most miners will neeeeever be recouping their inital cost , as of now 1 kda is at 1.56 euro and tbh i really dont see it spiking beyond 2.5 this year

Thanks for the update.

I’m guessing 27-30k. For ka3

What happens if KDA increases it’s block chain to 30 chains vs 20 ? Will this change the hash rate (lower)?

Update for everyone: Antminer KA3 166T 3154W KDA miner | BT-Miners

Looks like price is around $38k. Bt-miners is pretty legit, so this should be at least close.

@Dallas_Bowles I believe that somebody asked this question during yesterday’s q&a session at the end of the Kadena/Bitmain livestream. Unfortunately, I got distracted and missed the answer. The recording might have been posted on Youtube by now. If so, you could just watch the last 15 minutes or so

I guess what the point of getting a KDA BOX PRO …it will not be profitable

Especially at 1K

I bought 2 kd boxes pro when they were 6000 usd per box … If I mine for a year and KDA hit ATH 25 usd … I will get my money back …