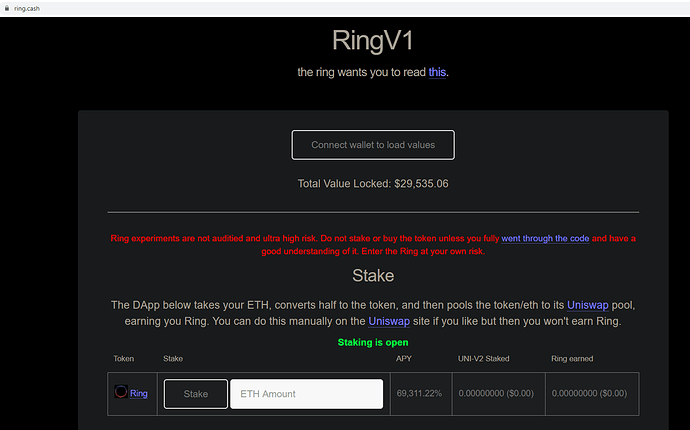

And for anyone looking for another one to jump in on early, there is https://ring.cash

I have not thrown in because I am tied up too much on apy.center at the moment.

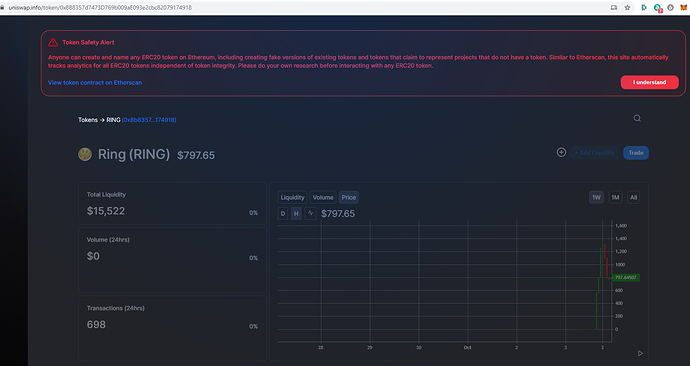

Seeing this makes the 1st one more like a scam now… like the loto

I just feel more and more are trying to push the long term staking in defi more than it feels like a scam. But I could be wrong. Their token is not very valuable yet.

I would walk through the code if you even consider staking this or any other.

I agree … and either way only spend what you can afford to lose… Thanks

Where do you get updates about the new coins/stakings?

I just happened to see it on the apy.center discord

Holy crap it wants $150~ for gas. I know gas prices are through the roof, but thats insane. EDIT: Ok that was for my entire wallet to be staked, misread the staking amount LMAO

Hello Everyone

I’m trying to understand the withdrawal process

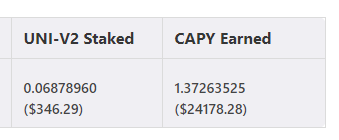

Once the time comes and withdrawal is available, I’m not getting the ETH I stacked directly back right?

I’m getting the CAPY that was obtained during stacking, and in the uniswap page I can change that CAPY back into ETH should I wish to do that? (Meaning I have to have a CAPY wallet on metamask)

I’m also not clear on the concept of UNI-V2 thats no directly UNI tokens, are they?

Thank you for your answers

here’s video on CAPY and how to withdrawl once time is up.

The uni v2 token is the stake u can take back and the CAPY rewards u can Just swap to eth in uniswap. i waset too sure too i counld’t make a CAPY token address to my meta mask account still? but I dont think u need to have a CAPY wallet in your metamask account. PLEASE SOME ONE CORRECT EM IF IM WRONG. APY.center says it its just 1 click to your main MM wallet

subtitles baby chyeaa!

Can you please map out the exit strategy?

So say you can withdraw CAPY and it’s still worth something?

Where to next? Send it to UniSwap to sell for ETH?

What’s the plan?

Thanks

Am I right in saying, The worst that could happen is u loose half your money, because half the money you staked is in eth, so if the coin zeros you still get your eth back (which is half)…

My plan is when my time is up im takeing HALF of EVERYTHING and restaking for another 3 to maybe 6 day depends on how this goes. I checked the contract and there is still alot of people getting on this right as im typing this .ill stay in touch with anyone that has questions.

And Foxie what u put in the last comment there is exactly what you are suppose to do , but when? is your decesion. stay safe guys ill be back on later tonight

sorry bro it was the best 1 i found hahah but it’s kinda understandable lmfao

Careful with CAPY, Vosk! It’s a fork of Orb, the original project that tried the “lock it up for 3 days” thing. What happened was, early stakers dumped the coin very hard when they could take it out. It was a crazy ride though to watch. People pumped the price all the way to 41k dollars with over 8M% APY. Those that simply bought Orb on Uniswap got the better deal as they could just sell the coin at a high price to take their profits, dumping it on the people staking.

But hope it turns out ok this time around for staker!

If you want to check out a top project in Defi that is killing it at the moment, check out CORE! In its first 24h after launch, CORE had more volume than USDT, DAI and USDC combined. It has been killing it ever since. And now you see projects like Nyan proposing to adopt CORE’s fundamentals of locking lp tokens forever, making it so that the project will always have liquidity.

=====================

Introducing CORE

CORE is a non-inflationary cryptocurrency that is designed to execute profit-generating strategies autonomously with a completely decentralized approach. In existing autonomous strategy-executing platforms a team or single developer is solely responsible for determining how locked funds are used to generate ROI. This is hazardous to the health of the fund as it grows, as it creates flawed incentives, and invites mistakes to be made. CORE does away with this dynamic and instead opts for one with decentralized governance.

CORE tokens holders will be able to provide strategy contracts and vote on what goes live and when, in order to decentralize autonomous strategy execution. 5% of all profits generated from these strategies are used to auto market-buy the CORE token.

=====================

Initial Distribution

The CORE team is kickstarting the initial distribution with a liquidity event. Contribute ETH to the CORE Fair Launch smart contract to receive tokens, and the contributed ETH will be matched and added to the Uniswap liquidity pool. Note that once added, liquidity tokens can not be removed from the CORE Uniswap LP pools. This is by design. Read on to learn about why…

=====================

Powered by Real Yield

To encourage real value and TVL to flow into CORE, CORE smart contracts employ interchangeable strategies that farm the coins inside the pools. This gives a great incentive to anyone who wants to farm CORE with coins other than CORE/ETH LP. All the yield from staked funds will go to market-buy CORE. This creates a positive relationship for both parties. CORE holders will always benefit from yield bearing activities done on the CORE smart contracts. Even when farmers sell, a transfer fee on sales of CORE tokens are returned to the farming pools. This means buying pressure will generally be more intense than selling pressure.

Bottom line - Governance ensures APY is higher in CORE Vault pools.

Many believe that the act of adding additional pools is disincentivized by the fact that it can dilute the rewards for the pools people are currently farming. In our model, this is lessened by the nature of CORE fees being paid out by additional farming pools. Although farmers are diluted in their rewards, the CORE they have appreciate in value due to the positive market pressure.

=====================

Deflationary Farming

Farming tokens have a problem for their owners. To keep users farming, they have to mint ever more coins. This completely destroys the value of the underlying token, due to excessive inflation. It’s easy to find examples of this across the DeFi ecosystem.

Our solution is called deflationary farming, and it is quite simple in only two steps:

- Charge a fee on token transfers

- Users can earn the fee by farming

This simple process means that those holding tokens are able to farm without infinite inflation.

=====================

Keeping Liquidity Liquid

All transfers have to be approved by the CORE Transfers smart contract, which will block all

liquidity withdrawals from Uniswap. This will guarantee a stable market, giving holders and farmers skin in the game.

=====================

Real Governance

CORE is designed for great community governance. The community decides everything, from developer fees, to deciding on the fee approver contract, adding new pools, rebalancing, and even disabling pools in the CORE Transfer contract.

If the holders decide COREVault should have a YFI pool, we can set

the ratio of fees it will be able to distribute, as well as when people should be

able to withdraw YFI tokens from it.

This creates an incentive to hold even more CORE by the holders of YFI tokens. Let the governance begin.

=====================

10000 CORE Forever

Theres absolutely no way to create new CORE tokens. This means the

circulating supply can only ever go down, period.

I really enjoy this pic for some reason  very pro

very pro

@VoskCoin: as I mentioned in the youtube comment that I will let you know on the progress - this is what I got so far:

Really hoping this will still be the case in 1day 6 hours and 34 minutes