High risk… high reward?? No Reward

Final APY Center CAPY update – Refund??

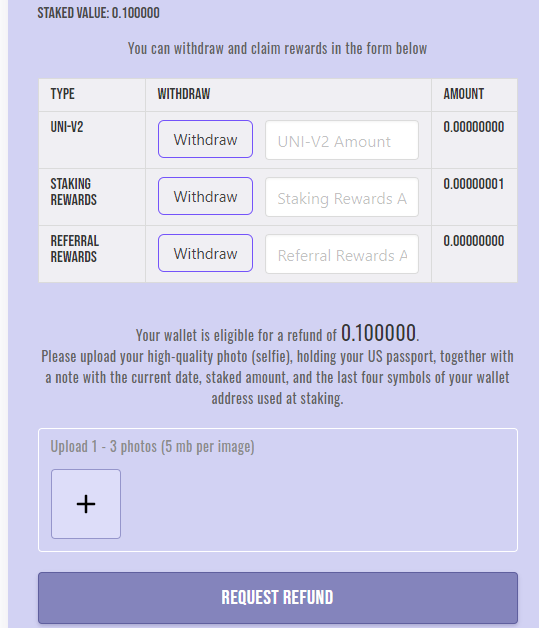

They are offering a refund, we are not recommending this or endorsing this. The summary is that if you upload a selfie holding your passport and a note with current date, staked ETH amount, and the last four symbols of your wallet used for staking – they claim they will refund you.

Seems like a scam right? Well numerous trustworthy community members have already been refunded, it is recommended that you black out all of your personal information in the selfie. @Dhoulmagus did this and still received his refund.

To be honest, this is astonishing, proceed at your own risk if you personally want to.

Here is another person that staked their Ethereum on APY Center into CAPY, they staked 0.5 ETH, and they uploaded their information for the refund and received their 0.5 ETH back.

According to Crypto Twitter Will Shahda is the creator of APY.Center / APY.Finance

DeFi sure is weird.

Edit update ~72 hours after launch

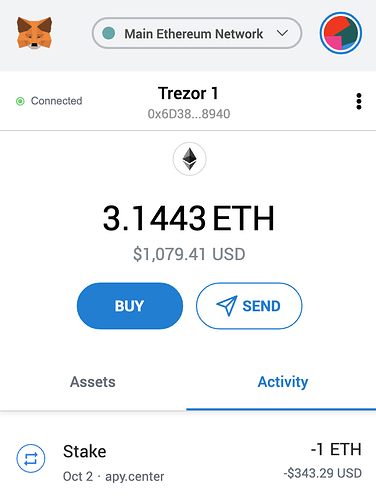

The best way to learn, is first hand, and that’s exactly why I just said I’m going to give this risky DeFi coin a spin.

I just want to let you know that this is incredibly risky, I’m not promoting this, I’m not recomending this, I would never put anything in here that you don’t expect to ever see again. Quoted from the original video upload based on a time-locked DeFi coin.

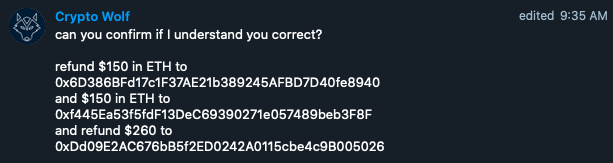

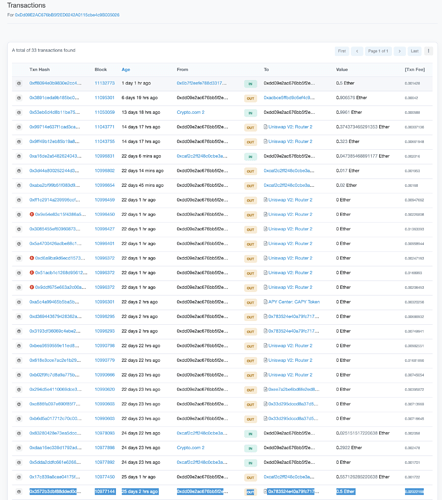

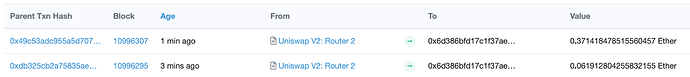

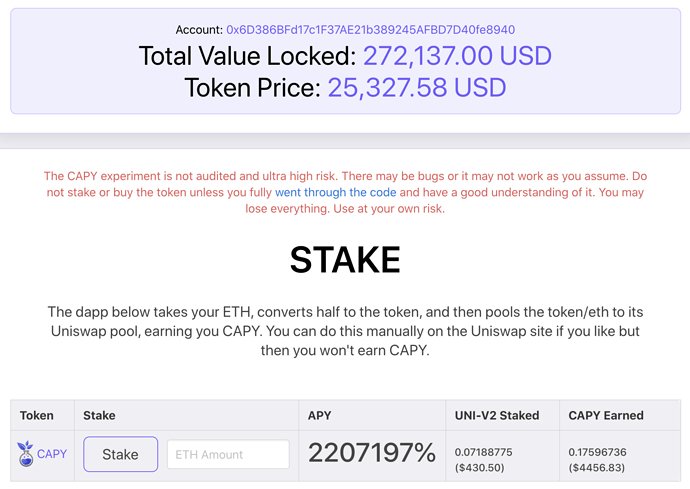

I wasn’t kidding when I said don’t do this and let me try it out for fun, so for anyone that is victimizing themselves and blaming me, stop. I shared my Ethereum address 0x6D386BFd17c1F37AE21b389245AFBD7D40fe8940 I was using from the start too, you can check the address on the blockchain to verify for yourself. That’s the beauty of blockchain.

[screenshot]

Anyway let’s summarize what happened and why this was a fat loss!

Fully realizing everything after the fact led to a lot of discoveries and realizing now that I had probably lost at the time of my stake to begin with – but I did not realize it yet. APYC/CAPY is a fork of Orb

It appears that anything with a lockup period is going to be an absolute dump once that initial lockup period expires, this isn’t particularly surprising and as I shared in my initial video I was planning to take these “unreal” profits when I was able to do so. So whoever got in first, well they did take those profits and realize gains of ~$200,000 worth of Ethereum.

When I staked into APYC/CAPY, my initial ETH was turned into 50% ETH and 50% CAPY (bought in at an absurd and basically inflated price point of ~$20k a coin) – this is why when the price collapses, my initial 50% in CAPY basically becomes worthless. This is one of the main lessons learned.

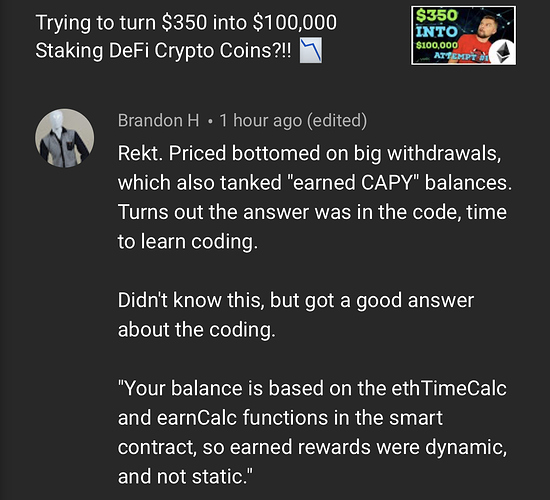

Here is something that freaking astonished me, the staking rewards ARE DYNAMIC?! whereas I would have naturally assumed they were static and as my staking reward coin quantity increased, I thought that was essentially set in stone.

“Your balance is based on the ethTimeCalc and earnCalc functions in the smart contract, so earned rewards are dynamic and not static.” This explains from a coding point of view why my staked earnings along with many others have diminished, and in this case… significantly.

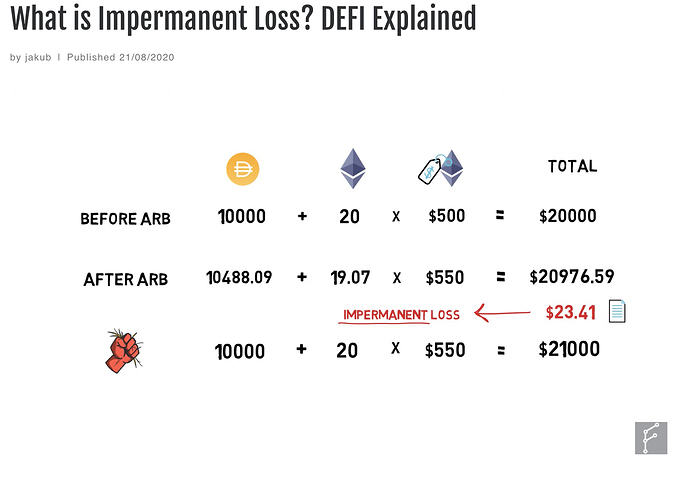

The realized loss also revolves partially around impermanent loss, here’s an awesome write-up and video suggested to me by @greer

Here’s an ELI5 via Reddit via @greer explaining impermanent loss on Uniswap

In uniswap you put in 50:50 of two tokens at the current market rate. When you withdraw you get 50:50 of each token at the new market rate.

If that results in a loss it’s called impermanent loss because if you wait long enough the fees earned should catch up to any losses, thus “impermanent”. Although, depending on the ratio, pool volume, waiting long enough could be waiting years so watch out. Providing liquidity on uniswap is still a risk!

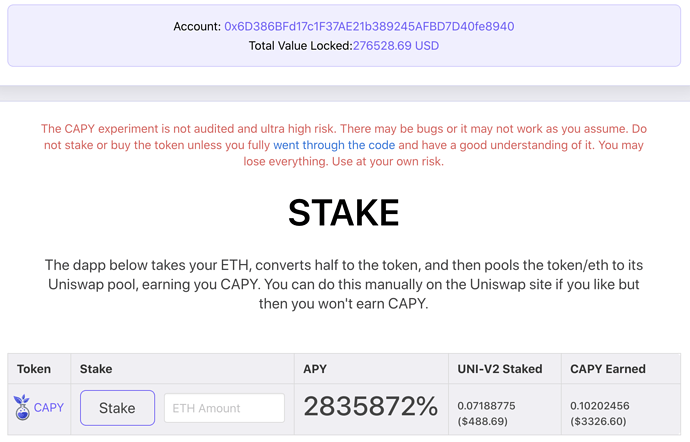

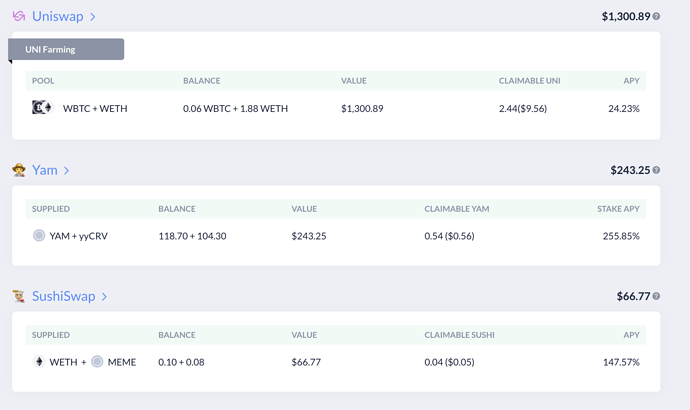

Ultimately I managed to recover about 0.4 ETH of my initial 1 ETH deposit, realizing a ~60% loss.

If you’re looking for the links to remove your uniswap pool liquidity and swap CAPY for ETH I pasted them below.

Below is the original (v2) post for reference and relevant links

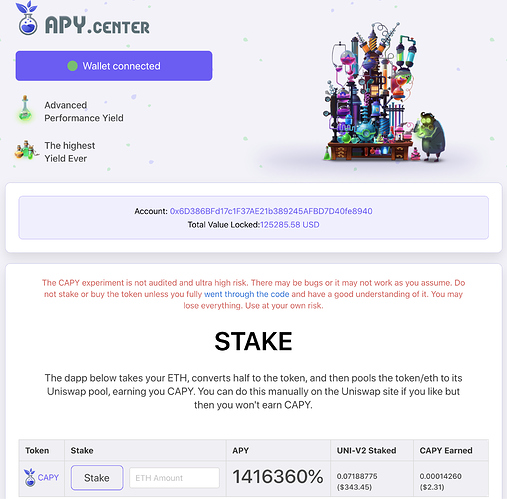

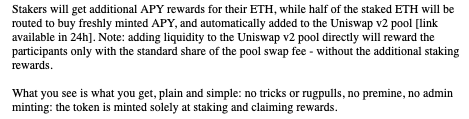

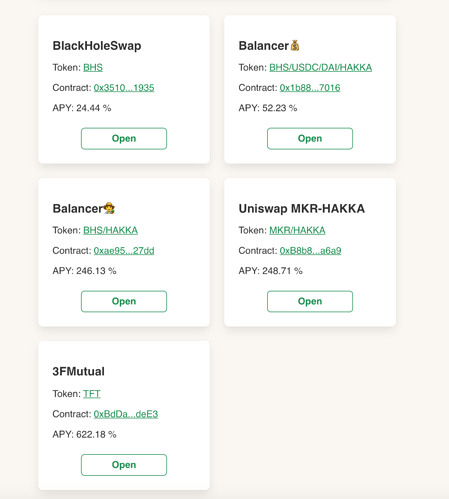

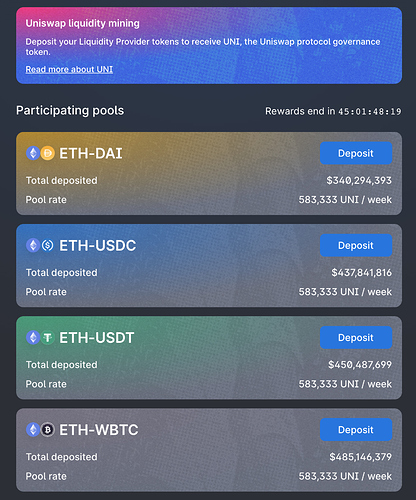

We’ve decided to jump or “ape” into the newest DeFi token to launch based around staking or yield farming or liquidity mining or whatever term people are using for this stuff. This is the riskiest side of the wild, wild, west that is cryptocurrency. Currently APY.center is promising a modest interest rate of 1,416,360%. We only discovered this new DeFi coin because they contacted us prior to launching the contract to review, which enabled us to participate on day one of the launch, lowering the risk factor.

Long story short I’m risking 1 Ethereum currently worth about $345 to earn 1,416,360% interest

This is all taking place on APY.center, if you want to support us recording super funny and risky ventures then if you choose to do this at your own super risk, use our link!

It’s likely I will never see this Ethereum/money invested ever again.

However, I could also earn the easiest $20,000+ dollars ever lol

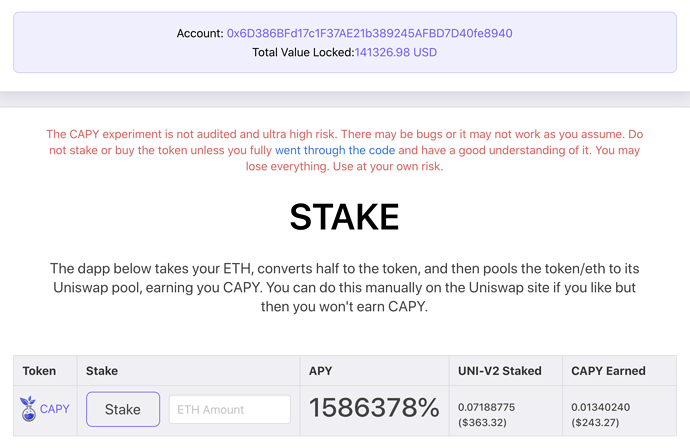

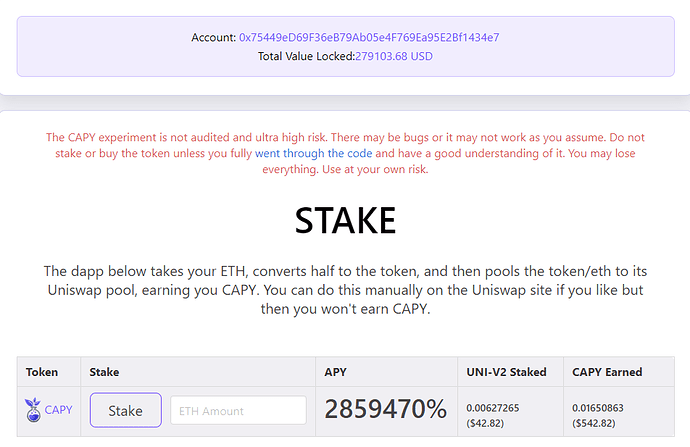

Here’s a screenshot of the total value locked and the interest rate on my initial CAPY stake

Here’s the transaction associated with apy.center from my Metamask.

15 minutes later, it claims I’ve earned $243 lol

About two hours later my ~$350 of Ethereum is now valued at about $3,700 lol, this is one of the craziest things I have ever witnessed first hand. Who actually thinks I’ll be able to get all of this money out? The total value locked is currently at ~$280,000.

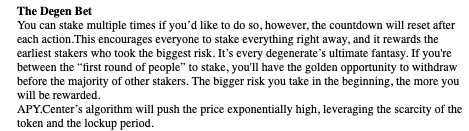

When could I realize my potential INSANE DeFi yield farming liquidity providing profits?! or losses… That would be in about 3 days, so yes, it is confirmed that APY.center is timelocking your rewards for 3 days, and in the DeFi crypto space, that is a very long time.

The associated Ethereum staking and token addresses for CAPY APY.Center

Staking https://etherscan.io/address/0x783524e40a79fC717853E0a732D84ea8Ed7BCefD#code

Token https://etherscan.io/address/0x367B072D50ac465bA47Ab474c6d381BfC0e45F86#code

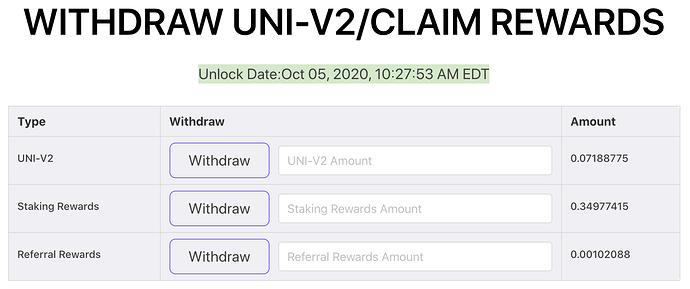

There’s some pretty interesting information they shared with me regarding their staking protocol, and that is every time you stake … the timelock on your reward withdrawals are *RESET. This is part of a document that they shared with me, stating exactly this.

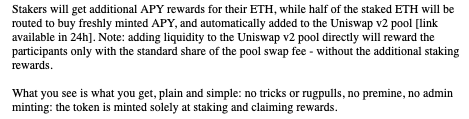

You can add liquidity to their Uniswap v2 pool directly, this will only reward you with the standard share of the pool swap fees and not the additional staking rewards awarded via their actual website.

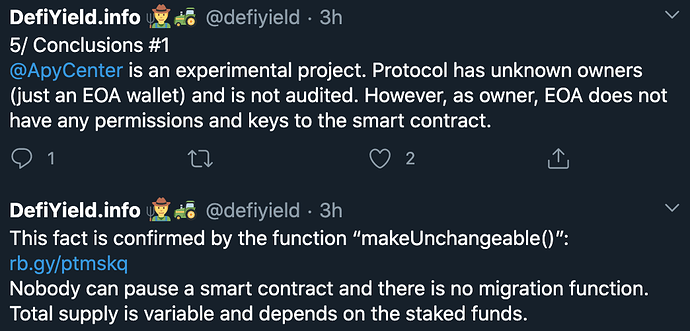

An interesting note when reviewing their code on Etherscan is this “makeUnchangeable()”, basically this is a smart-contract and code is law! Read DeFi Yield’s full tweet analysis here.

You can view the CAPY Ethereum ERC-20 token on Ethplorer.

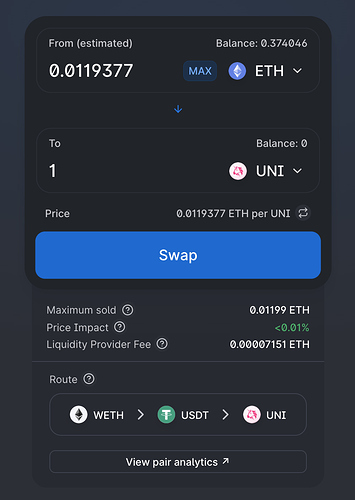

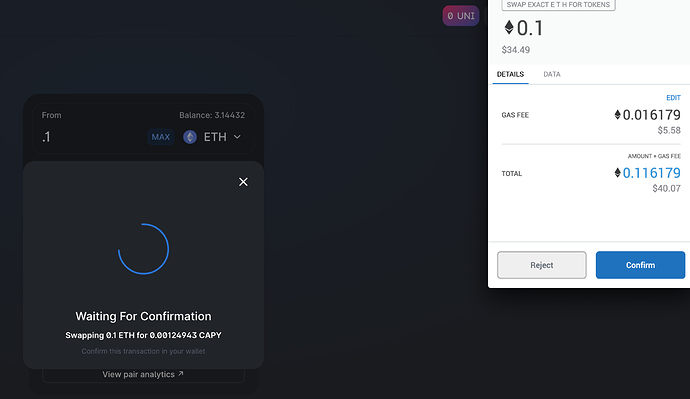

I decided to buy 0.1 ETH worth of CAPY directly on Uniswap, you can view the token pairing here. I purchased this at approximately $27,500 per CAPY so I could potentially double my Ethereum and pay the associated high ETH transaction fees at a price of $60,000 per CAPY. This is a way to participate in this token without receiving the bonus staking rewards and the 72-hour lockup period.

About 4 hours later they claim I have turned my 1 ETH ($350) into a whopping $4,900. I still have 68 hours to go before possible withdrawal though!

EDIT re-wrote the original post

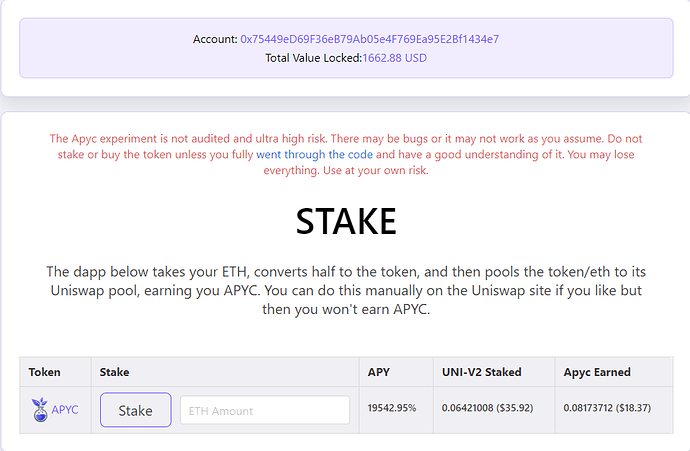

You can view the entire original post in the edit history of this post if you’d like. To summarize they had a bug in their code, and re-deployed the same insane APY ETH token contract the next day under the ticker CAPY as opposed to the originally planned APYC.

You can view the original APYC staking website here.

Here is their original Uniswap liquidity pool.

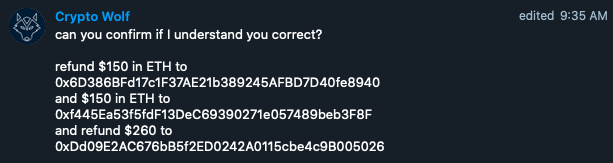

I had to request a refund personally via Telegram from Crypto Wolf

They are also compensating us to create a video review, so I was confident our community would receive a refund in this scenario. Moving forward it is back to proceed at your own risk. If you would like a refund of your ETH only, I would contact him via Telegram immediately.