Uniswap is both a decentralized exchange for ERC20 (Ethereum) tokens and it is a token itself. This post is about the Token.

Did you miss out on the $UNI token airdrop and have some crypto sitting in a wallet doing nothing? You can earn $UNI by staking your crypto on the Uniswap Exchange.

*Take a look at my quick introduction to the Uniswap Exchange if you need a little more information about what it is.

*You’ll need a web3 wallet such as metamask.

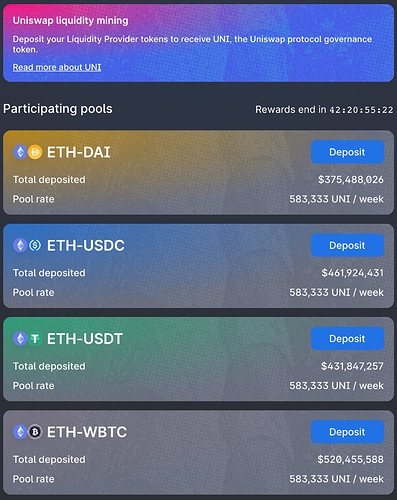

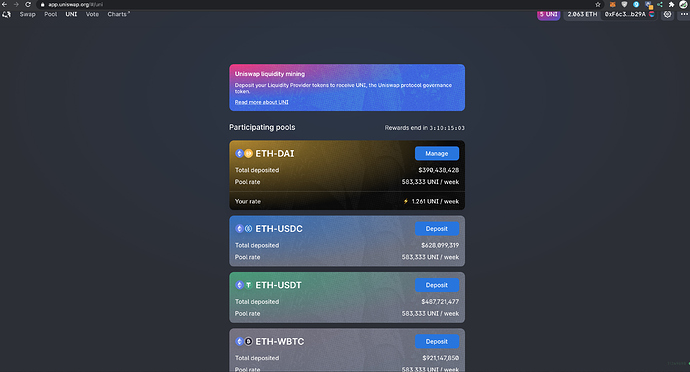

As of right now there is around 43 days left to earn UNI tokens by adding your crypto to a liquidity pool and then staking the LP tokens on Uniswap. You will earn commission on trading fee’s and UNI tokens.

Uniswap will pay an incentive in the $UNI token if you provide liquidity to one of these four pools:

ETH-DAI

ETH-USDC

ETH-USDT

ETH-wBTC

That is Ethereum and either one of the stablecoins DAI, USDC or USDT, or Ethereum and wBTC (wrapped Bitcoin or Bitcoin on Ethereum). If you want to be holding crypto because you believe ETH and BTC will keep going up then the ETH/BTC pair makes the most sense.

You’ll require exactly equal amounts in USD value of each of the tokens to enter the pool. If you already have that, you can proceed with making a deposit through https://app.uniswap.org. A simpler way is to use the https://zapper.fi website. Zapper enables you to enter and exit a pool with one token, handling all swaps for you.

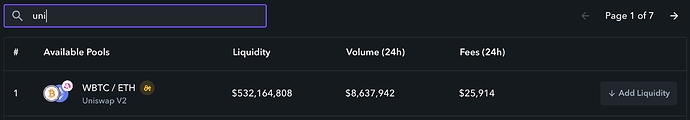

On Zapper’s invest page, you can search for ‘uniswap’ and find the pairs that have a tractor icon indicating a yield farming opportunity.

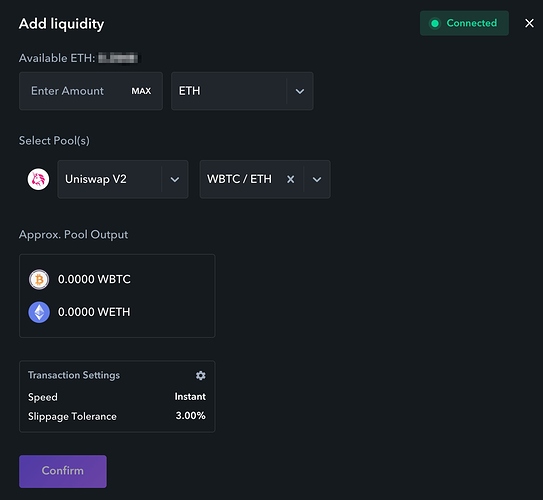

In this example I have chosen the WBTC / ETH pair on the Uniswap V2 exchange. Simply click the ‘Add Liquidity’ button to add funds to the pool and you will be presented with the following box.

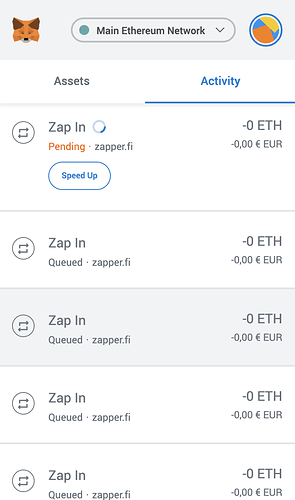

Here you only need to enter an amount in ETH from your connected web3 wallet and zapper.fi will exchange it for equal parts WBTC / ETH and make the deposit to the pool. Gas fee’s will reflect these multiple transactions and can be quite high.

I have set the speed to Instant which makes the gas fee’s even higher but transactions faster and increased my Slippage Tolerance to 3% to reduce the chance of a failed transaction due to volatility in price.

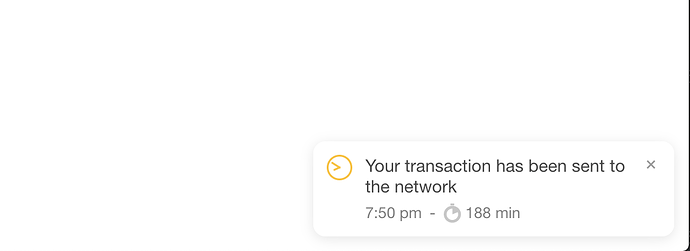

Once hitting confirm and approving the transaction you will be entered into the pool. The half of the ETH will have been converted to wBTC and deposited with the ETH to the pool. You will receive LP Tokens in return, they show up in your wallet as UNI-V2 but there are websites such as https://debank.com and https://zapper.fi that will show you more information on these LP Tokens.

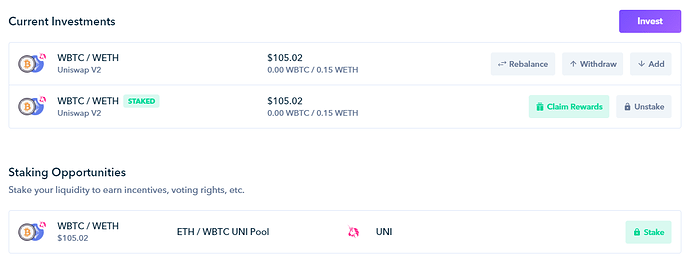

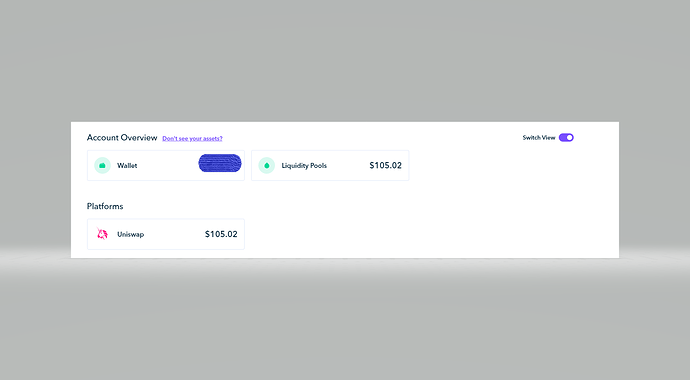

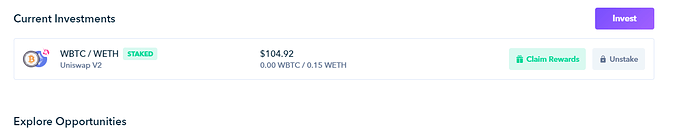

At this point you can visit the liquidity pool on Uniswap and see your deposits. They will also be reflected on the investments page of zapper.fi under 'Current Investments.

You’re not earning $UNI yet, only fees for providing liquidity. In order to start earning the $UNI tokens you need to ‘stake’ your liquidity tokens. You’ll notice a ‘Stake’ button on the zapper.fi investments page. Click that button and approve the transaction to start staking your LP token and earning $UNI.

You can unstake and withdraw from the pool at any time. You will stop earning $UNI when you unstake and stop earning fee’s when you withdraw from the pool.

Congratulations! You are yield farming $UNI tokens.