Uniswap is both a decentralized exchange for ERC20 (Ethereum) tokens and it is a token itself. This post is about the DEX.

Introduction

Uniswap is a completely decentralized cryptocurrency exchange on the Ethereum Network. More specifically it is an automated liquidity protocol. It doesn’t have complicated order books like centralized exchanges, instead it has a very simple swap interface.

As of this writing Uniswap has:

- 13k+ Token Pairs

- $292M 24H Volume

- $2.5B Total Liquidity

- 100+ Defi Integrations

that is more trading volume than Coinbase! Critics say that is because of the large number of shitcoins on Uniswap vs Coinbase, Uniswaps founder says otherwise.

Swaps

You select the token that you would like to swap from and the token that you would like to swap to. If you do not see the token in the list, you can add it using its contract address.

Uniswap charges a 0.3% fee for each swap. This fee is passed on to the Liquidity Providers (LP) which brings us to Liquidity Pools.

Liquidity Pools

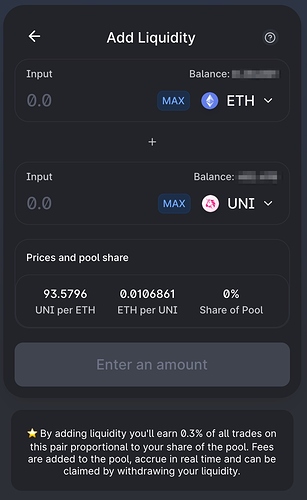

Anyone can become an LP by depositing equal amounts (in USD value) of any pair of ERC20 tokens to a liquidity pool. If a pool does not already exists, you can create one.

When you deposit a pair of tokens to a pool, you receive LP tokens in return. These tokens appear in your wallet as UNI-V2. As long as you have your LP tokens, you can remove your deposit from the pool.

While you are participating in the pool you will earn 0.3% of all trades on the pair proportional to your share of the pool. If you deposit tokens equal to 1% of a pool and someone makes a $10,000 trade in that pool you will earn the equivalent of $0.30 (($10,000 * 0.3%) * 1%) in whatever tokens were traded.

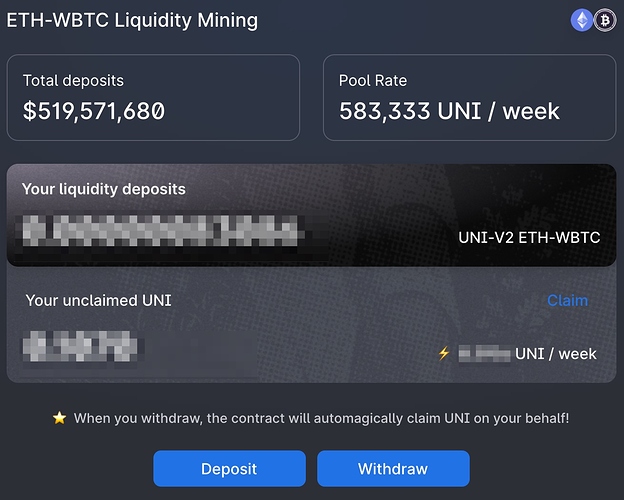

Staking

You can also stake your LP tokens to earn incentive tokens such as the UNI token, this is known as Liquidity Mining or Yield Farming.

While you’re staking your LP tokens will not be visible in your wallet, but you can still earn commission on pool fee’s. You will have to un-stake them before you can remove your deposit from a liquidity pool.